Tax

Tax

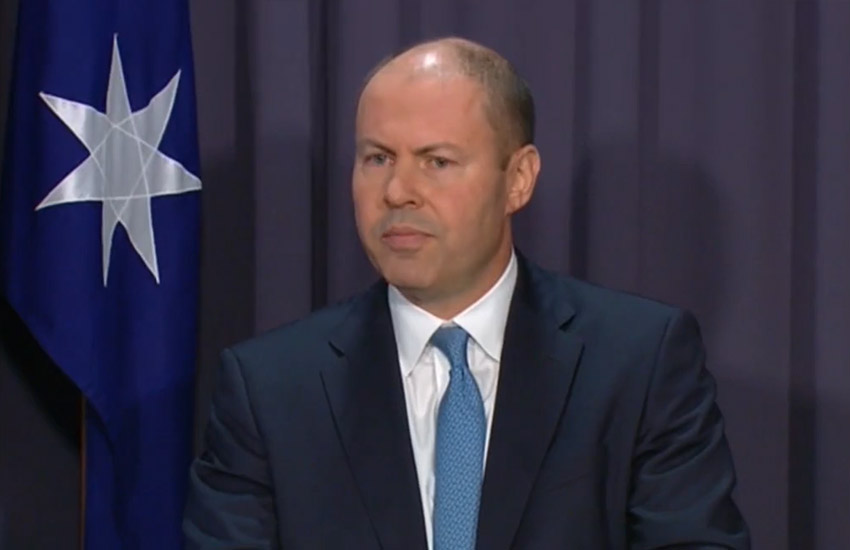

Frydenberg defends federal government stance on Victoria disaster payments

Treasurer Josh Frydenberg has set the record straight on how federal government has responded to Victoria’s COVID...

20 October 2021 • By Emma Musgrave

Tax

Work-from-home shortcut method extended

18 October 2021 • By Emma Musgrave

Tax

‘Significant investigation’: ATO reforms to create fairer tax system

18 October 2021 • By Emma Ryan and John Buckley

more from tax

Tax

Tax profession welcomes IGTO recommendations, urges ATO to go further

Leaders from across the tax profession have welcomed recommendations made by the IGTO on how the ATO could make...

15 October 2021 • By John Buckley

Tax

Tax watchdog finds ATO staff ill-equipped to handle taxpayer disputes

Staff at the ATO could be doing more to communicate “clear and complete” information, after a review of taxpayer...

14 October 2021 • By John Buckley

Tax

ATO doubles down on lodgement benchmark ‘support’

The ATO’s assistant commissioner has confirmed practitioners will not lose access to their lodgement programs if...

12 October 2021 • By John Buckley

Tax

Frydenberg welcomes historic OECD tax agreement

The majority of the world’s economies have agreed to setting a minimum corporate tax rate of 15 per cent as...

11 October 2021 • By John Buckley

Tax

ATO urges caution on publication of JobKeeper documents, responding to reports

A trail of JobKeeper documents released under freedom of information laws has prompted words of warning from the ATO,...

11 October 2021 • By John Buckley

Tax

‘We’re absolutely not out to get tax agents’: ATO

The ATO’s frosty relationship with the tax profession has been well documented in recent years, but change is underway...

08 October 2021 • By Robyn Tongol

Tax

ATO freezes $80m worth of assets detailed in Pandora Papers

A Gold Coast property developer has had more than $80 million worth of assets frozen by the Federal Court after he was...

08 October 2021 • By John Buckley