Tax

Tax

Rogue agent sees over 2,000 taxpayers impacted

Over 2,000 taxpayers in Western Australia who used an unregistered preparer to lodge their tax returns could now be...

21 September 2021 • By Jotham Lian

Tax

ATO eyes foreign income disguised as gifts, loans

21 September 2021 • By Jotham Lian

Tax

OnlyFans, Twitch, Patreon: ATO tightens the net on gig economy

20 September 2021 • By Jotham Lian

more from tax

Tax

Examining the new frontier of estate disputes

With litigation involving death benefits in SMSFs on the rise, the time is ripe to evaluate your plans and ensure that...

17 September 2021 • By Robyn Tongol

Tax

Working from home during a COVID-19 lockdown: Can you claim a tax deduction...

The ATO has long held firm on the principle that rent payments (being a form of occupancy costs) are generally...

17 September 2021 • By Andrew Henshaw and Fiona Bucknall, Velocity Legal

Tax

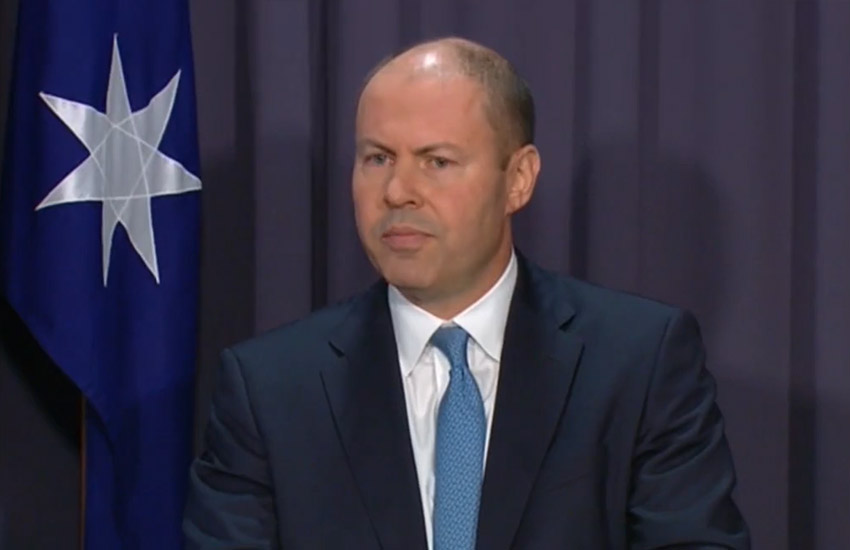

Frydenberg shuns OECD’s GST reform recommendation

Treasurer Josh Frydenberg has ruled out broadening the GST base and increasing its rate despite the Organisation for...

16 September 2021 • By Jotham Lian

Tax

ATO fires warning shots on cryptocurrency cost base, record-keeping

The ATO has warned advisers new to cryptocurrencies to be aware of the components that comprise a crypto asset’s cost...

15 September 2021 • By John Buckley

Tax

Commercial depreciation: Tips to maximise the benefits of commercial property...

Every commercial property is unique – an office building, warehouse or hotel will all present different complexities...

15 September 2021 • By Acumentis

Tax

ASIC bats away privacy concerns over JobKeeper disclosure

The corporate regulator defended its decision to force listed firms to disclose whether they’ve received JobKeeper,...

13 September 2021 • By John Buckley

Tax

Tax agent cops maximum ban over ‘wilful deceit’

A Victorian tax agent has been banned for the maximum five-year period after the Tax Practitioners Board found that he...

10 September 2021 • By Jotham Lian