Tax

Tax

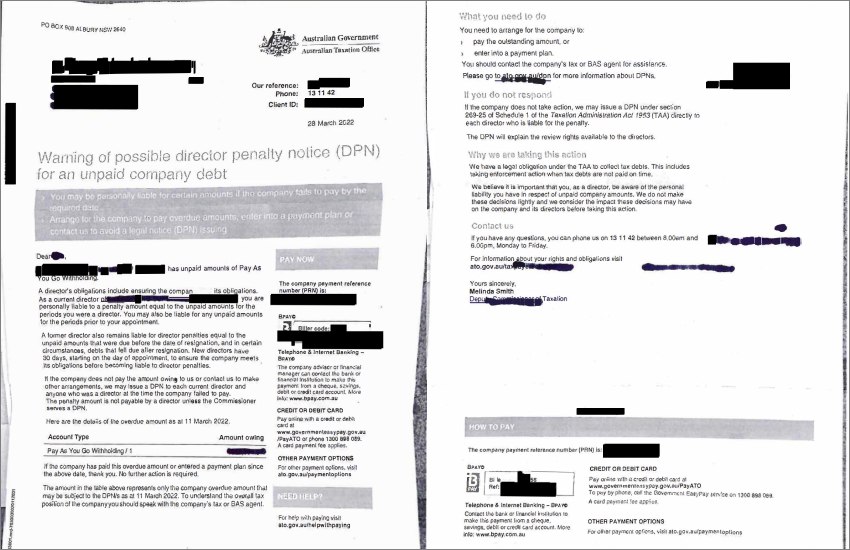

Time running out for 50,000 ‘nervous’ directors with ATO debt

The clock is ticking for thousands who were given a stern warning by the ATO to act on their tax liabilities late last...

28 April 2022 • By Tony Zhang

Tax

ATO urges vigilance following registration scams

27 April 2022 • By Tony Zhang

Tax

More than 2000 financial advisers ‘to quit this year’

27 April 2022 • By Tony Zhang

more from tax

Tax

ASIC bans 2 directors with $13m in debts

One in the restaurant business and another in construction failed to meet their obligations.

26 April 2022 • By Tony Zhang

Tax

Accountants call for role on Labor’s charity steering panel

CPA Australia says the profession can help the sector prepare strategies for the next disaster.

26 April 2022 • By Philip King

Tax

ATO will take hard line this year: H&R Block

Expect a stronger compliance regime after the office returns to business as usual.

22 April 2022 • By Tony Zhang

Tax

E-invoicing will reduce emissions, says PwC

Digitising billing systems would save almost $130 million annually in carbon emissions.

22 April 2022 • By Tony Zhang

Tax

ATO stands by ruling despite gym deduction win

But a successful claim by a prison dog handler could “open the floodgates”.

22 April 2022 • By Philip King

Tax

Doctor jailed for 18 outstanding tax returns

A seven-month sentence was handed down for failing to comply with court orders.

21 April 2022 • By Tony Zhang

Tax

Accounting in Forex

Since Forex is like any other business investment, the most crucial bit of having a stable and growing business is to...

20 April 2022 • By Animus Webs