Business

Frydenberg renews virtual AGM relief

The temporary relief measures will see companies able to hold annual meetings and sign documents virtually for another...

12 August 2021 • By John Buckley

Business

Time management tips for accounting professionals

11 August 2021 • By Practice Ignition

Business

Internal controls lag in the face of transformation: KPMG

11 August 2021 • By John Buckley

more from tag

Business

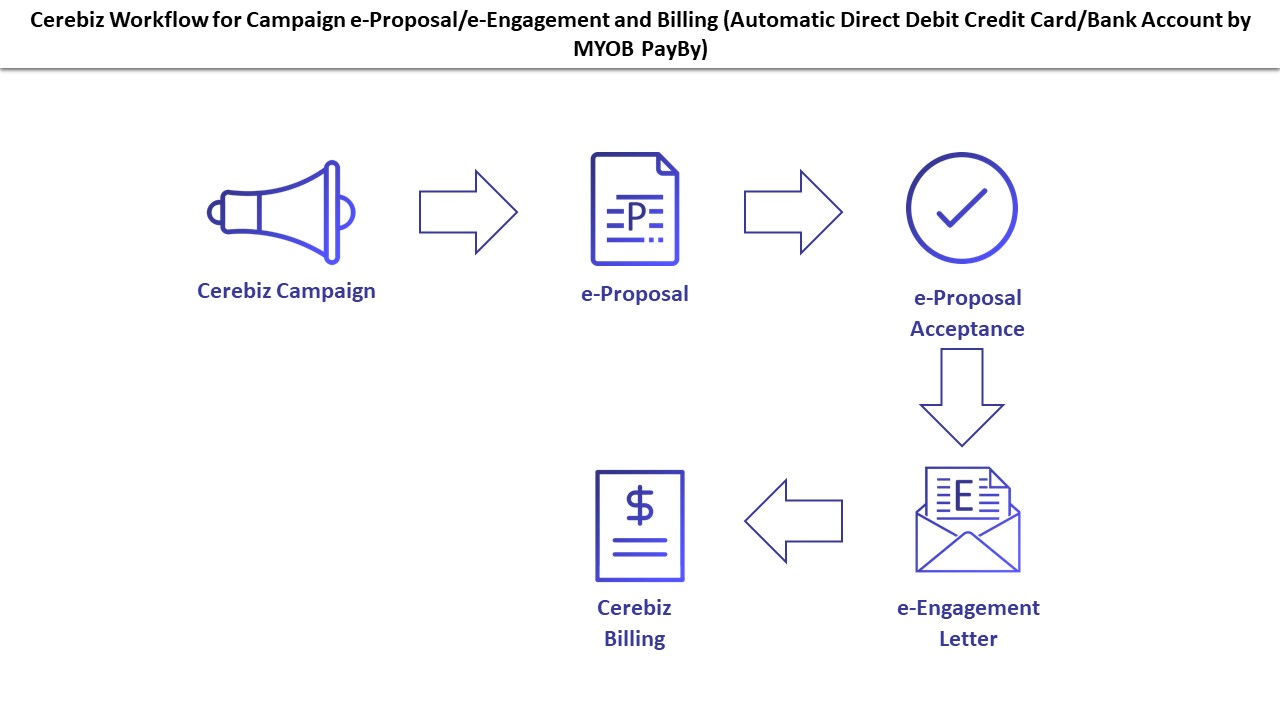

Optimise Workflow Tools for Accountants and Businesses with Cerebiz

Automate – Marketing campaigns, e-proposals, e-engagement letters, fixed fee (subscription) invoicing, direct debits,...

10 August 2021 • By Cerebiz

Business

Big 4 firms signal COVID-19 vaccine programs

From vaccine leave to plans to offer on-site inoculation, each of the big four firms has signalled moves to support...

10 August 2021 • By John Buckley

Business

SA businesses to receive lockdown recovery support

Small and medium businesses across the state are set to receive cash grants of up to $3,000 under a new scheme rolled...

10 August 2021

Super

A new generation of SMSFs

The SMSF industry has recovered well from recent economic changes but what does the future look like and what do we...

10 August 2021 • By Andy Forbes, Interim CTO, SuperConcepts

Business

Service NSW to address accountants in new COVID-19 support webinar

Tax practitioners will now have their questions on NSW’s COVID-19 business support measures addressed directly by...

09 August 2021 • By Jotham Lian

Business

Victoria expands business support for 6th lockdown

Over 90,000 Victorian businesses will soon receive automatic grants worth $2,800 as the state enters its sixth...

09 August 2021

Business

Technology use driving business success: CPA Australia

The rapid adoption of new technologies could be the key to high growth for smaller businesses who were caught off...

09 August 2021 • By John Buckley

Business

JobKeeper transparency bid slapped down by the House

The transparency measure would have forced firms to reveal how much they received in JobKeeper wage subsidies, after...

06 August 2021 • By John Buckley

Regulation

TPB prepares to usher in new era of regulation

Greater independence from the ATO and new sanction powers are among some of the changes the Tax Practitioners Board is...

06 August 2021

Business

KPMG books $1.9bn revenue in FY21

The big four firm posted a 9.4 per cent annual revenue increase for the 2021 financial year, which saw improved...

06 August 2021

Tax

‘Expect to be reviewed’: ATO sends warning to cash-flow boost rorters

The Tax Office says businesses that made significant changes to their wages in order to obtain a higher amount of the...

05 August 2021 • By Jotham Lian

Business

Service NSW sets up webinars to tackle business support confusion

Service NSW will now run a series of webinars on the state’s COVID-19 business support measures as accountants and...

05 August 2021

Regulation

ATO message of “don’t bet against the house” rings alarm bells!

In case you missed it, the ATO sent out a disturbing message yesterday warning property investors that they shouldn’t...

04 August 2021 • By TaxTank

Business

SME business conditions reach record high pre-lockdown

Improved trading, profitability and employment conditions across the SME sector each reached record highs in the June...

04 August 2021 • By John Buckley

Business

Women in the boardroom climb by 60% in 5 years

Australian boardrooms have seen a 60 per cent increase in the number of their female members over the last five years,...

04 August 2021 • By [email protected]

Tax

‘A direct attack on the profession’: Labor called to ditch $3k deduction cap...

Federal Labor has been urged to come clean on its plan to introduce a $3,000 deduction cap for managing tax affairs, a...

03 August 2021

Business

Melbourne accountant sentenced over $135k GST fraud

A Melbourne accountant has avoided jail time despite fraudulently obtaining over $135,000 in GST refunds on behalf of...

02 August 2021 • By Jotham Lian