Tax

Tax

Labor promises tax deduction for small business

Labor has promised a 30 per cent tax deduction for small businesses that hire younger or older jobseekers who have...

06 May 2019 • By Jotham Lian

Tax

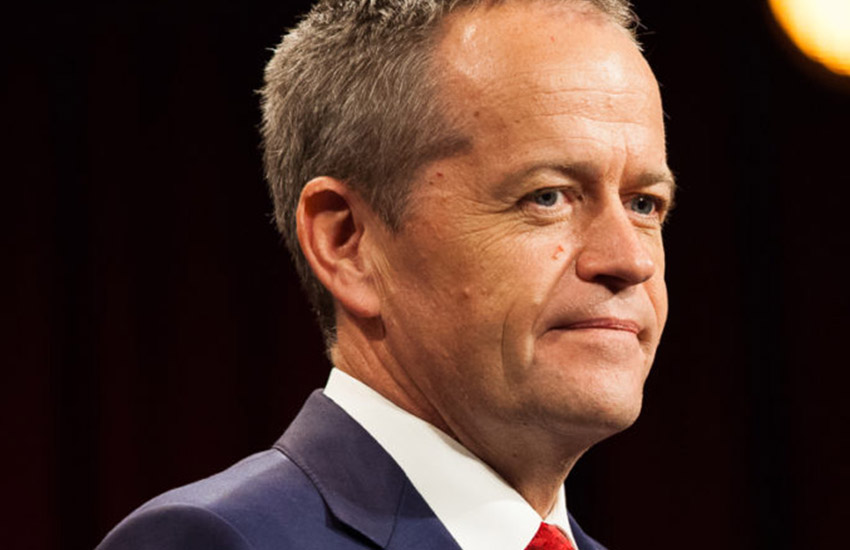

Franking credit recipients ‘already on public purse’, says Shorten

02 May 2019 • By Jotham Lian

Tax

Big four reveals partners’ average tax rate

01 May 2019 • By Jotham Lian

more from tax

Tax

Crypto transactions in ATO sights with new data-matching program

Up to 1 million taxpayers who have engaged in buying, selling or transferring cryptocurrency will now be subject to...

01 May 2019 • By Jotham Lian

Tax

AAT affirms TPB’s termination of tax agent registration

The Administrative Appeals Tribunal has upheld a decision by the Tax Practitioners Board to terminate a tax agent’s...

30 April 2019 • By Miranda Brownlee

Tax

ATO defends use of debt recovery action in ‘exceptional circumstances’

The Tax Office has defended its use of debt recovery action, arguing that it does so only in “exceptional...

30 April 2019 • By Jotham Lian

Tax

Labor commits $7bn in spending from tax proposals

Labor’s proposed tax changes will go towards close to $7 billion in spending on childcare subsidies and dental care,...

29 April 2019 • By Jotham Lian

Tax

Bowen clarifies franking credit figures

The shadow treasurer has sought to provide clarity in the calculation used in his previous example to support Labor’s...

29 April 2019 • By Jotham Lian

Tax

Tax Office figures paint different negative gearing picture

Tax Office figures on occupations that use negative gearing come at odds with Treasurer Josh Frydenberg’s claims that...

29 April 2019 • By Jotham Lian

Tax

Bowen’s franking credit figures pulled apart

Shadow treasurer Chris Bowen has been called out over the figures used in his franking credit rhetoric, with one tax...

26 April 2019 • By Jotham Lian