Tax

Tax

‘We were not consulted’: ATO lashed over new partner profit guidelines

The ATO’s failure to consult with peak professional bodies in developing its draft allocation of professional firm...

19 April 2021 • By Jotham Lian

Tax

Tribunal upholds agent’s registration termination for ‘grossly’...

19 April 2021 • By John Buckley

Tax

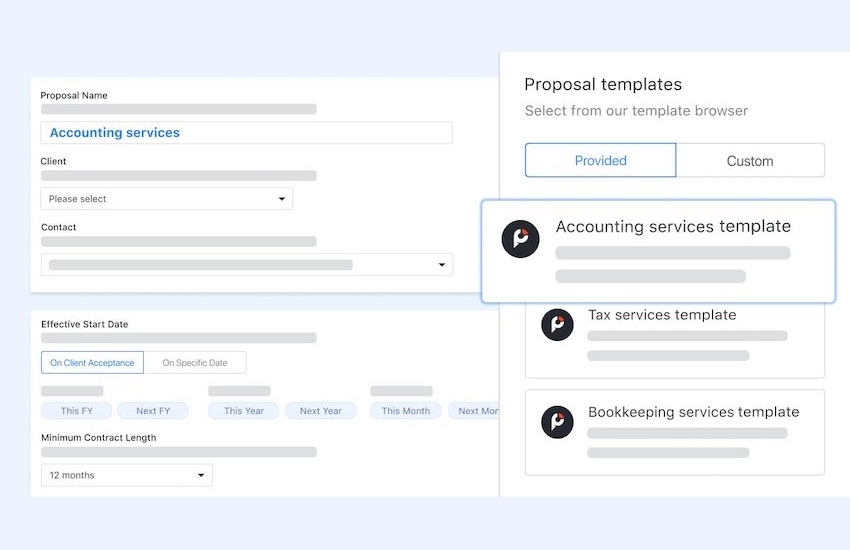

Complimentary FBT Engagement templates to mitigate your risk of...

16 April 2021 • By Practice Ignition

more from tax

Tax

ATO ‘intimidating’ firms under new partner profit guidelines: IPA

Accounting firms are being intimidated by the ATO into conservative tax arrangements, says one major body, as tensions...

16 April 2021 • By Jotham Lian

Tax

ATO launches new tax residency data-matching program

The tax residency status of Australians and foreign residents are set to undergo closer scrutiny by the ATO as it...

15 April 2021 • By Jotham Lian

Tax

NSW payroll tax avoidance penalties set for 400% increase

Penalties for payroll tax avoidance are set to rise five-fold in New South Wales as the Berejiklian government looks...

15 April 2021 • By John Buckley

Tax

‘Unconscious bias’: ATO reviews should rely on independent experts

The ATO’s independent review service should involve an independent expert to account for unconscious bias, says one...

15 April 2021 • By John Buckley

Tax

ATO to ramp up audits to capture unpaid duty on alcohol

Bottle shops and restaurants can soon expect contact from the ATO and potential audit action as it looks to tighten...

13 April 2021 • By John Buckley

Tax

NSW government pushed for details on proposed property tax

The New South Wales government’s plan to replace stamp duty with an annual property tax could result in purchaser...

12 April 2021 • By Jotham Lian

Tax

Tax consequences highlighted ahead of trans-Tasman bubble

As international border restrictions between Australia and New Zealand lift, and corporate events ramp back up,...

12 April 2021 • By John Buckley