Complimentary FBT Engagement templates to mitigate your risk of audit exposure

Tax

Offering fringe-benefits tax returns to your clients mitigates risk of audit exposure - we’ve now made it even easier for you to engage your clients for FBT with our free templates.

Have you avoided engaging your clients for FBT returns in the past? Common practice has been to not lodge a return if there is no FBT Payable, as your clients usually don’t understand the intricacies involved and why they should pay you to lodge. The reality is that for nearly all of your business clients, you should be lodging an FBT return.

Clients often presume that:

- There are no benefits and therefore no tax will be incurred

- Employee contributions are used to offset FBT Payable - and are journaled at year end, so there is no need for a full return to be lodged.

But, did you know that failing to lodge an FBT return means the ATO can audit your clients going back indefinitely. By lodging an FBT Return, you cap the review period at 3-years. You will also de-risk your firm from being accused of not providing tax services in the case of an audit.

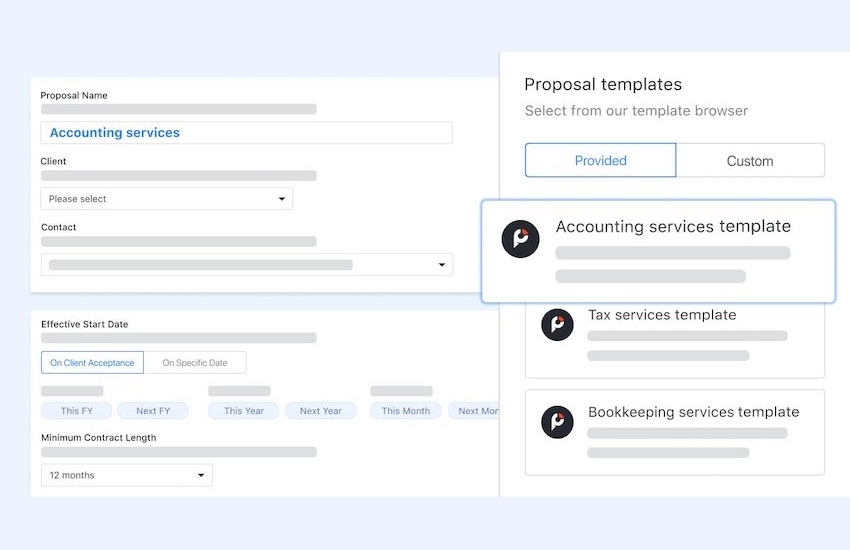

Practice Ignition has made it even easier for you to engage your clients for FBT returns, by providing free templates including:

- The scope of what you should include, with multiple options

- The engagement letter and

- Baseline pricing for the service

FBT returns offered through Practice Ignition are an easy way to “upsell” your clients and add more value with compliance.

Access a comprehensive library of service templates for accounting and bookkeeping professionals, including recommended pricing and scope for each service by starting a 14-day free trial.

You are not authorised to post comments.

Comments will undergo moderation before they get published.