Tax

Tax

ATO promises not to ‘destroy’ businesses as it resumes debt collection

Businesses struggling with tax debts have been urged to re-engage with the ATO as it pledges not to “destroy the very...

23 April 2021 • By Jotham Lian

Tax

Senator floats tax reform to lure business investment, immigration

23 April 2021 • By John Buckley

Tax

Value behind traditional lodgements is diminishing, says the ATO

22 April 2021 • By John Buckley

more from tax

Tax

Government reveals new disciplinary regime for tax financial advisers

Practitioners providing tax financial advice will no longer need to be registered with the Tax Practitioners Board...

20 April 2021 • By Jotham Lian

Tax

FBT, CGT exemption draft legislation surfaces

Draft legislation for two federal budget announcements last October has now been released, including measures to...

19 April 2021 • By Jotham Lian

Tax

‘We were not consulted’: ATO lashed over new partner profit guidelines

The ATO’s failure to consult with peak professional bodies in developing its draft allocation of professional firm...

19 April 2021 • By Jotham Lian

Tax

Tribunal upholds agent’s registration termination for ‘grossly’ misapplying...

A tax agent who amended tax returns without consulting his clients, failed to pay personal tax debts and misled...

19 April 2021 • By John Buckley

Tax

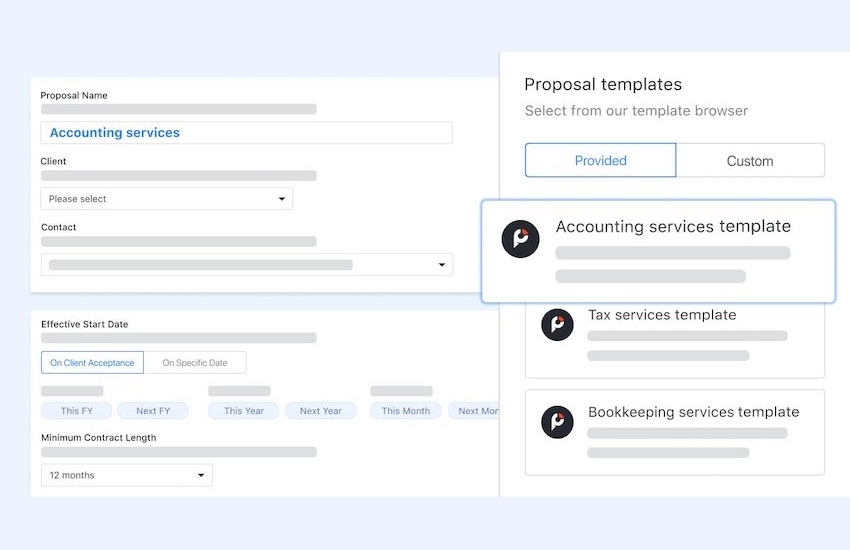

Complimentary FBT Engagement templates to mitigate your risk of audit exposure

Offering fringe-benefits tax returns to your clients mitigates risk of audit exposure - we’ve now made it even easier...

16 April 2021 • By Practice Ignition

Tax

ATO ‘intimidating’ firms under new partner profit guidelines: IPA

Accounting firms are being intimidated by the ATO into conservative tax arrangements, says one major body, as tensions...

16 April 2021 • By Jotham Lian

Tax

ATO launches new tax residency data-matching program

The tax residency status of Australians and foreign residents are set to undergo closer scrutiny by the ATO as it...

15 April 2021 • By Jotham Lian