Technology

ATO apologises for database failures

The ATO has implemented multiple changes to its legal database that are expected to resolve technical issues that have...

24 August 2020 • By Jemelle Blanco

Appointments

The Tax Institute appoints new tax counsel

24 August 2020

Regulation

TPB-ATO independence in the firing line as terminations spike

21 August 2020

more from tag

Tax

Cash-flow boost, JobKeeper ‘discrimination’ petition launched

A petition to the government to change a cash-flow boost anomaly that disadvantages quarterly or annual lodgers has...

21 August 2020

Business

Victorian government extends eviction moratorium

The Andrews government will extend its ban on evictions and rental price increases until the end of the year, as...

21 August 2020 • By Jotham Lian

Regulation

ATO eyes early 2021 introduction of director ID regime

Director identification numbers are set to come into play early next year, as the ATO commits to rolling out the new...

20 August 2020

Technology

ATO could be doing your BAS soon, tax boss hints

Commissioner Chris Jordan has hinted that business activity statements could soon be fully automated as the ATO...

20 August 2020 • By Jotham Lian

Business

1,000 ‘high-risk’ tax agents in TPB’s sights

The Tax Practitioners Board will target 1,000 high-risk agents and unregistered advisers this financial year as it...

20 August 2020

Regulation

Corporate insolvency law in crisis in a time of crisis

Promoted by CPA Australia We should take note of lessons from the past and seize the opportunity to build a better...

19 August 2020 • By Dr John Purcell, Policy Adviser - Environmental, Social and Governance at CPA Australia

Tax

The latest tax audit claim stats that all accountants in Australia will want...

Promoted by Accountancy Insurance Be in the know with the latest tax audit claim stats and how JobKeeper attracts...

19 August 2020 • By Accountancy Insurance

Business

1 in 4 businesses rejected for new loans

Small businesses are shying away from borrowing, while those who are looking for finance are being knocked back by...

18 August 2020

Regulation

Leave entitlements during COVID-19 – What you need to know

Promoted by ADP Australia and New Zealand Get up to speed on changes to leave entitlements and plan ahead to meet your...

18 August 2020 • By ADP Australia and New Zealand

Tax

Tax evasion promoter jailed after 19-year investigation

A key conspirator of an elaborate multimillion-dollar tax evasion scheme has now been sentenced to six years in jail.

18 August 2020

Business

‘There will be failures’: RBA’s Philip Lowe sounds insolvency warning

Reserve Bank governor Philip Lowe has warned of an inevitable wave of business failures after September when...

17 August 2020 • By Jotham Lian

Super

AFP charges 3 people with early access to super fraud

The Australian Federal Police have charged three people with allegedly submitting false claims to withdraw over...

17 August 2020

Business

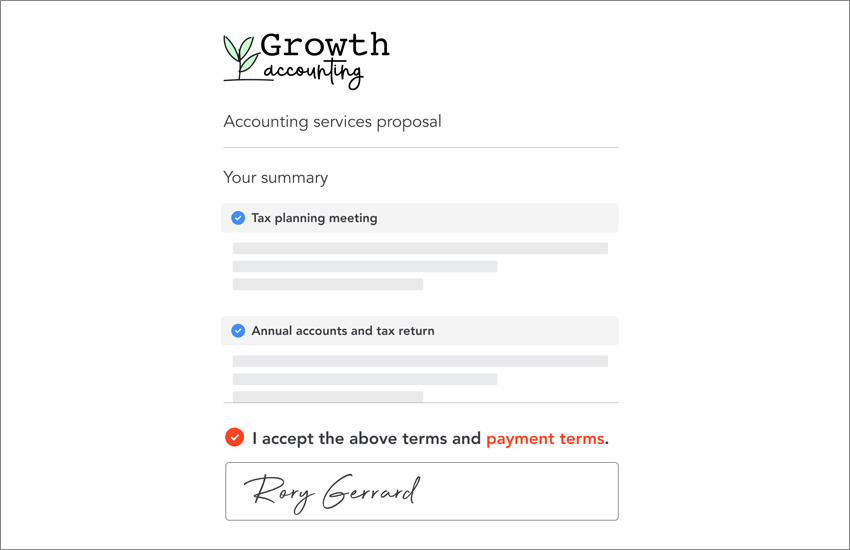

[Free eBook] How to revolutionise your client engagements

Promoted by Practice Ignition Understanding the importance of client engagements written by Head of Accounting,...

17 August 2020 • By Rebecca Mihalic, Head of Accounting, Practice Ignition

Business

$3.3m tax-evading agent faces maximum disqualification

A tax agent who was found to have evaded over $3.3 million in taxes for his wife and himself has now been struck off...

13 August 2020

Business

Navigating 2020 – business recovery in the age of COVID-19

Promoted by CPA Australia

12 August 2020 • By CPA Australia

Tax

Incoming ATO audits tipped to focus on JobKeeper, employer obligations

JobKeeper audits are expected to go on for two years, while the ATO’s scrutiny of employer obligations is set to...

12 August 2020

Business

TPB ramps up terminations with 129% spike

Tax practitioner terminations have jumped by 129 per cent as the Tax Practitioners Board credits a more efficient...

11 August 2020