Business

WA man charged over $2.57m tax evasion, ATO impersonation

A Perth man could face up to 22 years in jail for impersonating an ATO officer and failing to declare $7 million in...

26 April 2021 • By Jotham Lian

Business

Vaccine rollout key to Australia’s economic recovery

26 April 2021 • By John Buckley

Business

KPMG confirms 4% pandemic bonus

22 April 2021

more from tag

Business

Early access to super used to pay mortgages, credit cards, bills

New data shows that nearly a third of those who applied for early access to their superannuation as a result of...

22 April 2021

Regulation

Illegal early access scheme operator pleads guilty

A financial adviser who operated a scheme providing illegal early access to superannuation funds for his clients has...

22 April 2021 • By Jotham Lian

Business

Deloitte Australia reveals new chief executive

The big four firm has announced Adam Powick as its new CEO, taking over from Richard Deutsch who abruptly resigned in...

21 April 2021 • By John Buckley

Technology

ATO kicks off work on new centralised business mailbox

Australian businesses will soon have all ATO and government correspondence delivered to a single mailbox as the Tax...

21 April 2021 • By John Buckley

Business

Morrison reveals deregulation plan to save businesses $430m

In the lead-up to the federal budget, the Prime Minister has announced his government will spend $120 million on...

21 April 2021

Business

How to secure the best funding solution for your business

Traditional lending options are falling behind in the era of new loan structures. Learn how flexible financing could...

20 April 2021 • By ORB Alternative

Business

‘Extremely risky’ bank request on the rise, accountants warned

Accountants are increasingly being pressured to provide capacity to repay statements, as real estate agents and...

20 April 2021 • By John Buckley

Tax

Government reveals new disciplinary regime for tax financial advisers

Practitioners providing tax financial advice will no longer need to be registered with the Tax Practitioners Board...

20 April 2021 • By Jotham Lian

Business

Cerebiz Cloud Based Tools for MYOB and Xero go beyond accounting

Cerebiz cloud based tools and virtual collaborative platform supports practices as they look to improve their post...

19 April 2021 • By Cerebiz

Business

Tribunal upholds agent’s registration termination for ‘grossly’ misapplying...

A tax agent who amended tax returns without consulting his clients, failed to pay personal tax debts and misled...

19 April 2021

Business

FSC pushes for financial advice reform

The Financial Services Council (FSC) is hoping to drive a massive simplification of advice in order to prevent it from...

19 April 2021 • By Lachlan Maddock

Business

What are the accounting and audit shifts you need to know about?

Annual Chartered Accountants Australia and New Zealand Accounting and Audit conferences essential for professionals.

16 April 2021 • By Chartered Accountants

Tax

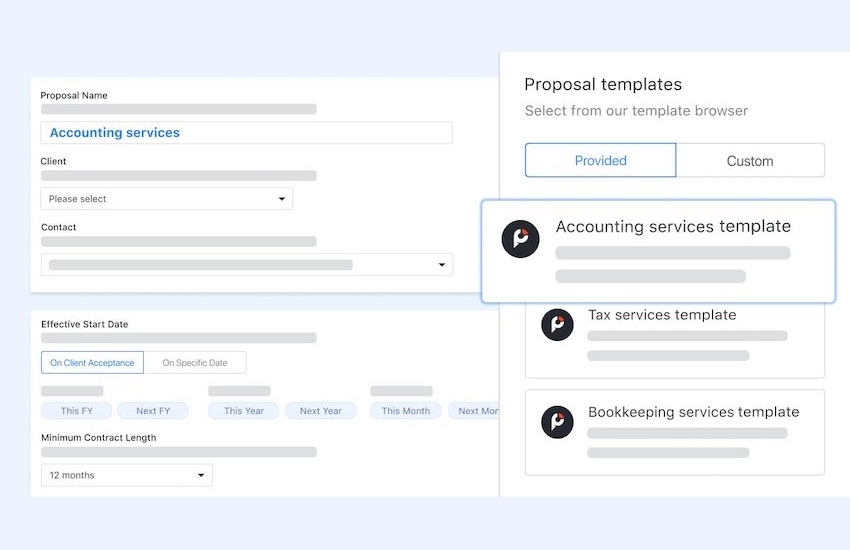

Complimentary FBT Engagement templates to mitigate your risk of audit exposure

Offering fringe-benefits tax returns to your clients mitigates risk of audit exposure - we’ve now made it even easier...

16 April 2021 • By Practice Ignition

Business

ASIC extends COVID-19 record of advice relief

The corporate regulator’s record of advice relief measure has been extended to 15 October, with an option to withdraw...

16 April 2021 • By John Buckley

Business

‘More Australians in work than ever before’: Frydenberg

The latest round of employment data showed employment, participation and hours worked all up for March.

16 April 2021 • By John Buckley

Business

Australian Accounting Awards 2021 shaping up to be closely contested

Nominations for the Australian Accounting Awards are coming to a close, with 36 awards set to be hotly contested this...

15 April 2021 • By Jotham Lian

Regulation

JobKeeper ends but ATO audit activity on the program set to continue

Despite the conclusion of the JobKeeper wage subsidy program, the ATO is set to continue keeping a close eye on those...

14 April 2021 • By Roman Kaczynski & Rod Spicer