ATO sheds light on crypto compliance focus

The Tax Office has urged advisers and taxpayers alike to heed its guidance on accounting for cryptocurrency come tax...

Sample announcement strip lore ipsum dolor sit met. CTA HERE

The Tax Office has urged advisers and taxpayers alike to heed its guidance on accounting for cryptocurrency come tax...

Shadow Treasurer Jim Chalmers has come out in support of a national scheme to do away with land tax and stamp duty,...

A specialist team of ATO officers focused on providing lodgement support to tax practitioners has now been established...

In a pre-budget announcement on Saturday, the Andrews government said it will move to hike land tax and stamp duty in...

The ATO has launched a new concierge service to help tax practitioners with their lodgement program as it resists calls...

Shadow treasurer Jim Chalmers signalled Labor will look at curtailing the tax cuts off the back of the government’s...

The delivery of the research and development tax incentive is set to undergo scrutiny by the Board of Taxation as the...

Businesses that fall into the Top 500, Next 5,000, and medium and emerging private groups programs should be on guard,...

While the government’s newly announced reforms to individual tax residency emerge as a positive step towards boosting...

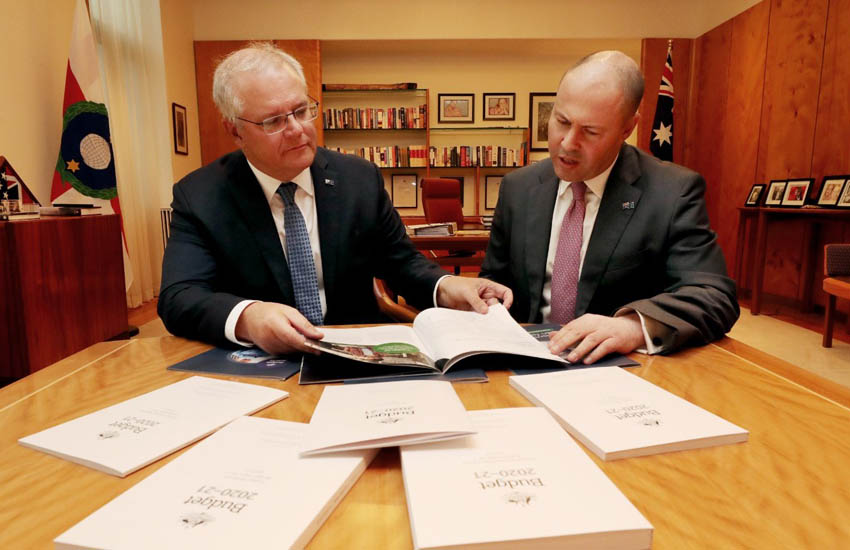

The government will extend the temporary full expensing and loss carry-back measures for a further 12 months as it...

Up to 10.2 million workers will continue to benefit from a $1,080 tax offset for a further year as the government locks...

Recognising the leading individuals, brokerages and aggregation groups around the nationThis national awards program...

KNOW MOREGet breaking news