Short-changed for lodging quarterly: A case study

TaxA case study of a recent ATO decision on the eligibility of an entity for the cash-flow boost highlights the strict interpretation of a tax period adopted by the Tax Office for the government’s stimulus measures.

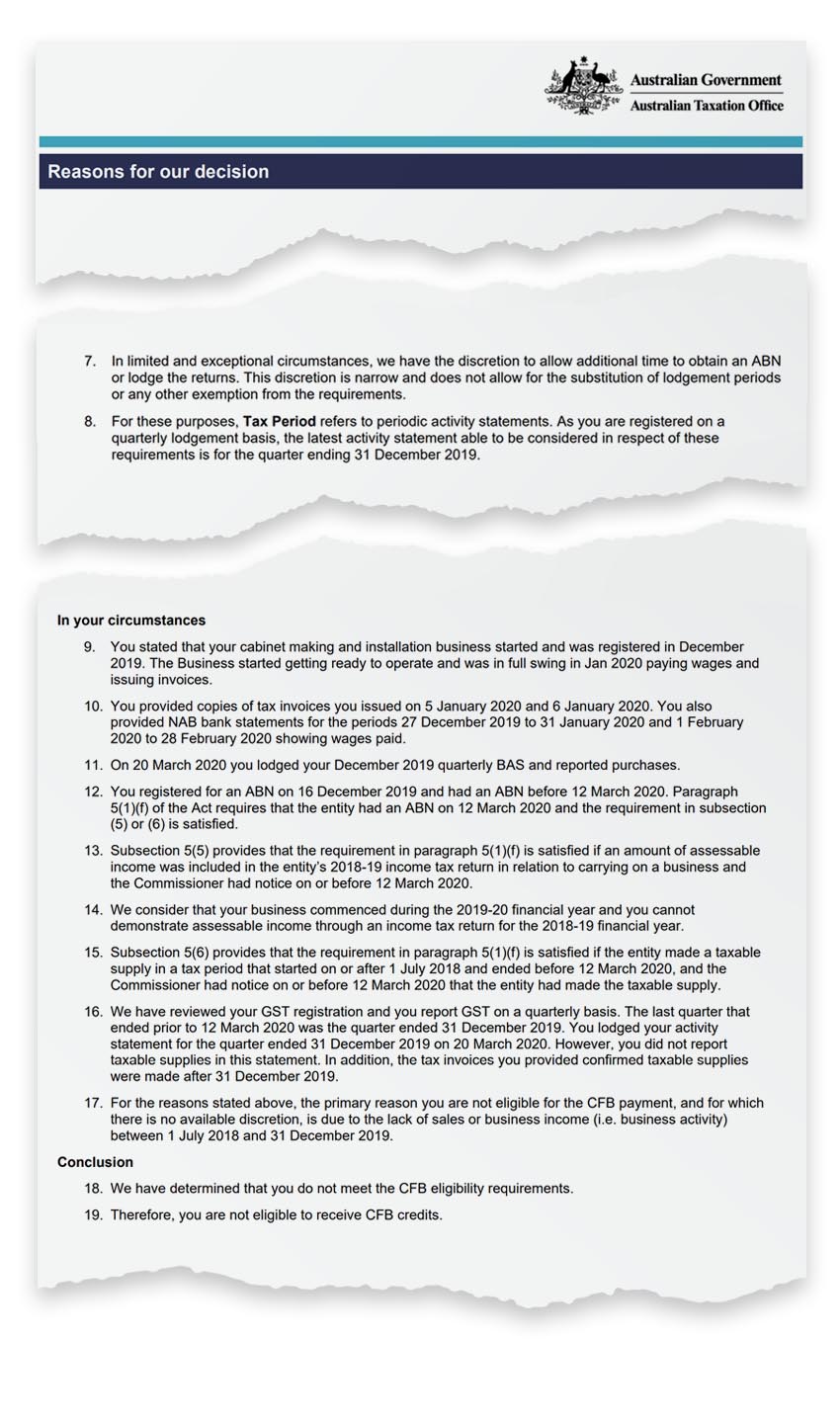

The case study, provided by the Institute of Public Accountants, shows how access to the government’s stimulus measures — such as JobKeeper and the cash-flow boost — is denied for certain new businesses due to the restrictive nature of having to provide notice of taxable supplies to the ATO before 12 March.

In this case, a cabinet maker met all the other eligibility requirements, but was ultimately denied access due to the fact that he had only made taxable supplies in January 2020 and his last statement to the ATO was for the quarter ended 31 December 2019.

The taxpayer provided proof of taxable supplies made in January 2020, but it was not considered because it fell outside his elected reporting cycle.

Had the taxpayer been registered on a monthly lodgement basis, rather than quarterly, he would have qualified for the stimulus measure.

The IPA’s general manager of technical policy, Tony Greco, said the ATO has taken a strict interpretation of the law.

The ATO’s views are confirmed in its Practice Statement Law Administration (PSLA) 2020/1 where it notes that the commissioner does not have the discretion to extend the date by which an entity can make a taxable supply, and can only extend the date by which notice of the made supply is provided.

“The ATO hasn’t budged from [its] interpretation,” Mr Greco told Accountants Daily.

“We are seeing other agents who have acted with an objection and the confirmation is that the client doesn’t meet the eligibility criteria.”

A joint submission by nine professional bodies has since called for the restrictive tax notice requirement to be amended.

They have called for the notice requirement to be amended by importing an assumption that either a monthly or quarterly tax period applies, and to allow the commissioner to use evidence of “making a taxable supply” in those notional tax periods up to 12 March 2020, in order to allow businesses to satisfy eligibility requirements.

Mr Greco said the government has already shown an appetite to change the rules, including with the childcare sector and those who have PAYG withholding on PSI.

“The easiest way to fix it would be for the government to change the rules,” he said.

“The Treasurer has tweaked the rules a couple of times and they are obviously not picking up the mantle here to remove all doubt where we want these people in because it does fit within the policy intent.

“There doesn’t seem to be a valid reason to exclude these types of legitimate businesses from support.”