ATO slams brakes on debts campaign in face of backlash

TaxFrustrated tax agents complained of letters about on-hold tax debts of just a few cents that were a waste of time to reconcile.

The ATO has slammed the brakes on its on-hold tax debts awareness campaign “in response to community feedback” after a backlash from agents who complained of alert letters over just a few cents.

“The ATO has heard the concerns raised by the community. We have paused the awareness campaign and will review our overall approach on how we communicate about debts-on-hold,” it said.

“The purpose of the letters was to ensure people had full visibility of their existing debts with the ATO, where collection had been put on hold.”

“These debts relate to tax returns for past income years. The letters provided a reminder about existing debts but did not require payment.”

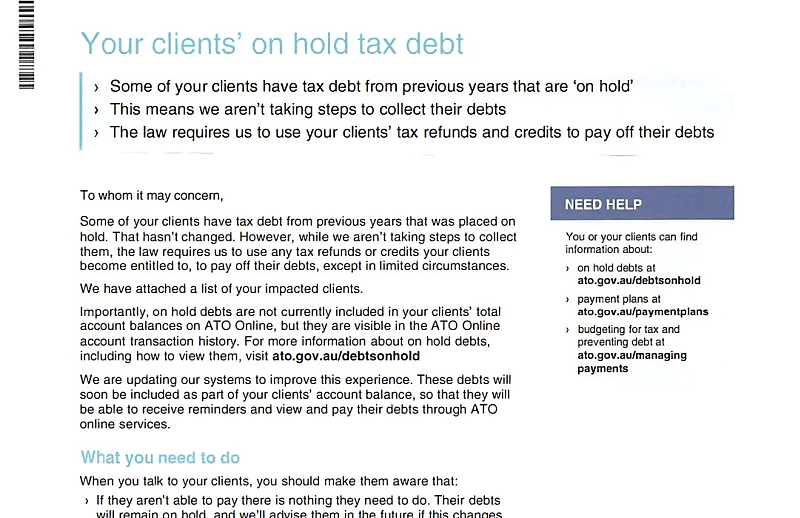

As part of the campaign, the ATO sent out at least 28,000 alert letters in late October saying that previous debts on hold that had been written off as “uneconomic” to recover would be revived and offset against clients’ tax refunds or credits.

The ATO said it still would not pursue collection but “the law requires us to use any tax refunds or credits your clients become entitled to, to pay off their debts”.

However, it was quickly accused by frustrated tax agents of “scraping the barrel” in reviving “petty” debts worth cents with many dating back decades, directed to deceased taxpayers or defunct businesses, and that they were a waste of time to reconcile.

The ATO has backpedalled on the campaign in the face of the backlash.

“It’s important to us that taxpayers have trust in our tax system and our records,” it said.

“We verified that all debts exist, and that all taxpayers were previously informed when the debt was originally incurred through their notice of assessment. Taxpayers can check whether they have a debt on hold by calling us.

“However, we accept that our communication approach caused unnecessary distress – especially for those debts incurred several years ago. We will review our overall approach to debts on hold before progressing any further.

“No further action is required by anyone who has received a letter. However, if you have questions about your existing tax debt, you can contact the ATO for further information.”

The ATO said it did not take active steps to recover tax debts on hold but the debt remained payable.

“We expanded this approach to support the community during COVID-19 and paused offsetting debts previously put on hold entirely, meaning debts were not deducted from tax refunds or credits,” it said.

“This approach was reviewed by the Australian National Audit Office as part of our financial statements audit. This review found excluding any existing debts from being offset was not consistent with the law, regardless of when the debt arose.”

“The ATO investigated further and received clear advice that all debts must be offset. It is required by law. The ATO does not have the power to forgive or waive a tax debt.”