Tax concessions, FBT exemptions announced ahead of budget

TaxGreater access to small business tax concessions, including exemptions from fringe benefits tax, has now been unveiled by the federal government.

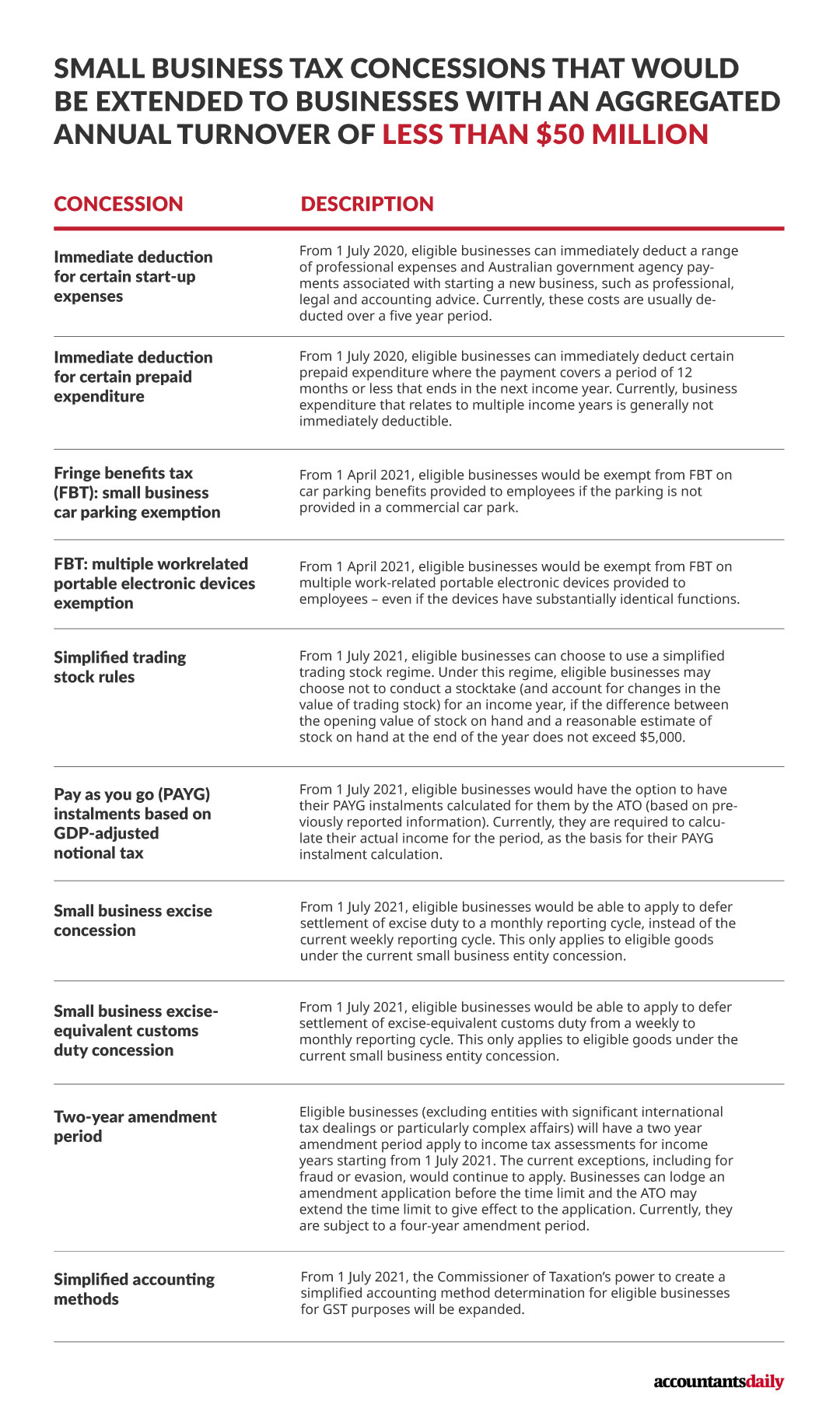

Treasurer Josh Frydenberg has announced that the small business entity turnover threshold will now be increased to $50 million, up from $10 million.

The measure, to be outlined in Tuesday’s federal budget, will allow 20,000 businesses to access 10 tax concessions previously available only to small businesses, at a cost of $105 million to the government’s bottom line.

From 1 April 2021, eligible businesses will be exempt from the 47 per cent fringe benefits tax on car parking and multiple work-related portable electronic devices, such as phones or laptops, provided to employees.

Businesses will also be able to immediately deduct certain start-up expenses and Australian government agency payments associated with starting a new business, such as professional, legal and accounting advice. The measure is set to apply retrospectively from 1 July 2020.

From the next financial year, eligible businesses will be able to access simplified trading stock rules, remit pay-as-you-go (PAYG) instalments based on GDP adjusted notional tax, and settle excise duty and excise-equivalent customs duty monthly on eligible goods.

In addition, from 1 July 2021, the Commissioner of Taxation’s power to create a simplified accounting method determination for GST purposes will be expanded to apply to businesses below the $50 million aggregated annual turnover threshold.

Eligible businesses will also have a two-year amendment period apply to income tax assessments for income years starting from 1 July 2021, a reduction from the current four-year amendment period.

“We know that the pathway to recovery is not through higher taxes but through a more competitive and efficient tax system that supports jobs and promotes investment,” Mr Frydenberg said.

“Australia’s more than 3 million small and medium businesses are the engine room of our economy, which is why reducing their tax burden is critical in ensuring they not only survive the crisis, but continue to invest, grow and create jobs as the economy recovers.”

FBT exemptions for retraining and reskilling

The government will also outline a plan to remove the 47 per cent FBT on retraining provided by employers to employees who have been made redundant or are facing redundancy, to help them obtain a different role in the company.

The measure will apply to all businesses, with hopes that it will encourage training and reskilling for future work.

The government will also look to consult on allowing an individual to deduct education and training expenses they incur themselves where they are not related to their current employment.

“Making it easier for businesses to upskill or reskill their workforce will help people to keep their job or to find a new job as we recover from COVID-19,” Mr Frydenberg said.

“As the Prime Minister has said, the jobs and skills we’ll need as we come out of the crisis are not likely to be the same as those that are lost.

“These changes will help more Australians find work as part of our plan for economic recovery.”