Fair Work publishes JobKeeper legacy guidance for tax, BAS agents

TaxFair Work has now released guidance around the JobKeeper legacy employer 10 per cent decline in turnover test, alongside a template turnover certificate.

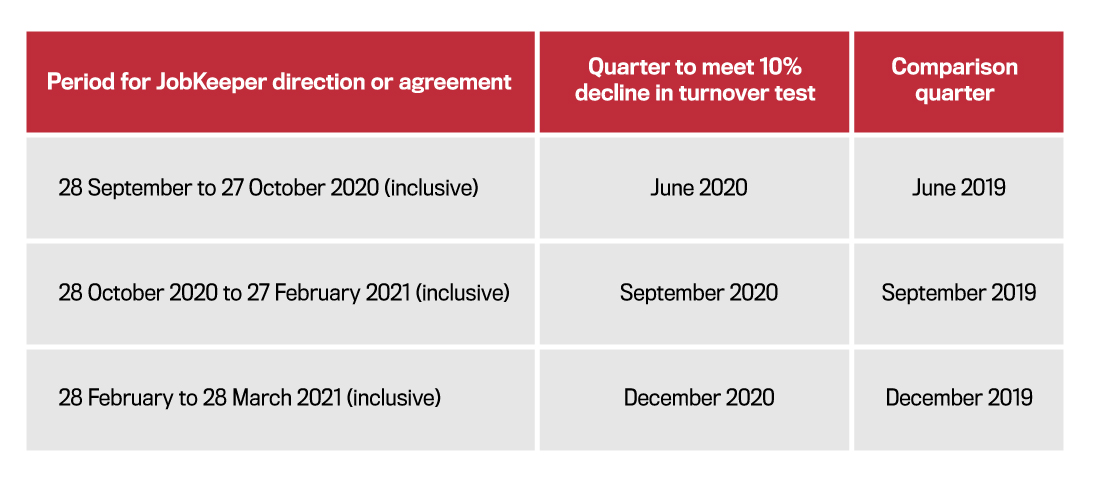

With the extension of JobKeeper to 28 March 2021 now in place, the government has provided a concession for employers who are no longer able to qualify for JobKeeper 2.0 to continue accessing temporary Fair Work Act provisions if they are experiencing a 10 per cent decline in turnover.

These temporary provisions include directions to reduce employees’ ordinary hours by 40 per cent of the hours they worked before the pandemic struck, and directions in relation to duties and location of work.

To continue being able to give JobKeeper enabling directions, employers will need to acquire a 10 per cent decline in turnover certificate from either a registered tax agent, a BAS agent or a qualified accountant.

Fair Work has now released further details of the actual decline in GST turnover test, with employers required to obtain a decline in turnover certificate for each quarter they intend to access the extended JobKeeper provisions.

Fair Work notes that practitioners who are issuing the decline in turnover certificates are not required to complete an audit or assurance engagement of the employer’s accounts and records.

Instead, they are required to confirm that the test has been met based on the information provided by employers, with penalties for employers who knowingly provide false or misleading information to a registered tax agent, a BAS agent or a qualified accountant.

Fair Work has also released a template decline in turnover certificate for practitioners to use.

Small-business employers

Small businesses with fewer than 15 employees will be allowed to provide a statutory declaration instead of obtaining the decline in turnover certificate from a registered tax or BAS agent.

The statutory declaration will need to be completed by the employer or someone who is authorised by the employer, and will be required to have knowledge of the employer’s financial matters.

A statutory declaration template can be accessed from the Attorney-General’s Department’s website.

View Fair Work’s latest information and template certificate here.