QuickBooks Content Connection

Dedicated resources, inspiring stories and the latest industry news & views

EXPLORE NOWClearing the way for accountants

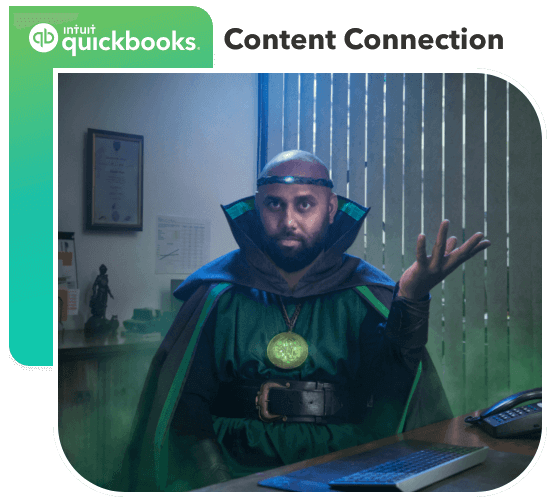

Matthew Pisarski briefly abandoned his fascination with technology to pursue an education in accounting, before realising that he could dip his toes in both and make a career out of helping his peers adopt and adapt to IT.

Matthew Pisarski joined Intuit when the company was in its infancy. His first role was in IT sales, which meant he was on the road five days a week, helping accountants up their efficiency.

Matthew and Intuit have grown side by side. In just under six years, he has transitioned into a strategic partnerships’ role, while Intuit has grown from nine to over 150 employees.

“I have always had an IT background, I remember building computers, I was obsessed with them. And then for some odd reason I thought you know what, let’s do accounting. So, I did accounting,” Matthew recalls.

Accounting first

He says that back then, he saw accounting as a means to lay the foundation for his future career.

“If you do accounting as a degree, you learn a lot about the different types of business units,” Matthew says.

After completing his studies, Matthew admits to looking for jobs in accounting practices, before deciding to take a gap year that would change the course of his adult life.

Namely, while trotting the globe he realised that rather than crunching numbers, he would prefer to clear the way for accountants and ease their transition to technology.

“Ever since I came back, I worked in various sales roles. But then Intuit popped up and it looked very interesting. It was a very exciting opportunity to launch the company here,” he tells us.

Back then Intuit was very much a start-up on the Australian market.

“We had the financial backing of the US company, but we were essentially a start-up. Everything was new, we were in serviced offices. I remember we spent my first day setting ourselves up, connecting the computers,” says Matthew.

But, he explains that even though Intuit was a newcomer, the reputation of its accounting software package QuickBooks proceeded the company’s physical entry into the Australian market.

“Even a lot of the competitors you see today, that use different types of accounting platforms, chances are that a lot of those partners had in some stage of the life used the QuickBooks desktop,” Matthew says.

Foretelling the future

Matthew reveals that the team at Intuit was very gifted in predicting the growth of technology.

“The one thing that people don’t know about Intuit is that we launched our cloud offering in 2001, so we were actually the first to market in the cloud space, globally,” he clarifies.

“So, we kind of knew, even back then, that cloud technology would be part of the future.”

But it was in early 2014 that the adoption of technology really started to sprout.

Although the past five years have been rocked by change, Matthew predicts that there’s a whole lot yet to come.

“If we’re looking at advisers specifically, I think the next wave will take place within their own practice,” he says.

“I think a lot of them are dissatisfied with their current solutions, because a lot of partners do the right things, but I think now things are all about consolidating and having one platform and making those integrations better.”

From his on-ground experience, Matthew says that the process accountants currently follow is very disjointed.

In the future, he says, more providers will offer a one-stop shop that allows accountants to perform all their tasks from one platform.

“You will basically just log in and you will have four or five different apps that you probably don’t even know you are using; they will just be embedded in that platform. I actually believe that will be the future,” Matthew says.

He reveals that the main focus for tech providers over the next year will be prep for taxes, practice management and an automated “single ledger” concept, which refers to the ability for accountants/bookkeepers to all work from one single source of data.

But, given the rapid evolution of tech, Matthew advises accountants to get on-board before playing catch-up actually becomes thorny.

“Take that first step, it’s not that scary. Challenge yourself,” he says.

What he sees regularly is that half of the accountants are reluctant to take that first step, while others “jump the gun too quick”.

Human focus

According to Matthew, Intuit owes its success to its fruitful partnerships with accountants.

“As opposed to worrying about the sales, we really just go in there and work with the accounting firms. Their success is our success,” he says.

“A lot of the competitors in the market value that in Intuit. It is a very different approach and our growth has been based on this.”

Today, Matthew is somewhat of a celebrity at Intuit.

Having been there from the very start, he is an integral part of Intuit’s success story.

“It’s interesting, because everyone that joins now, they’re like ‘you probably don’t know me, but I know you’. So, everyone knows you,” Matthew says with a laugh.

Want more time to work on, not in, your practice?

Leave your details to get access to a range of time saving tools from Intuit QuickBooks.Latest Articles

Login

Login