Government flags further insolvency reforms

RegulationSmall businesses that operate through a trust will now be considered for further protection, as the government mulls further insolvency reforms as part of the federal budget.

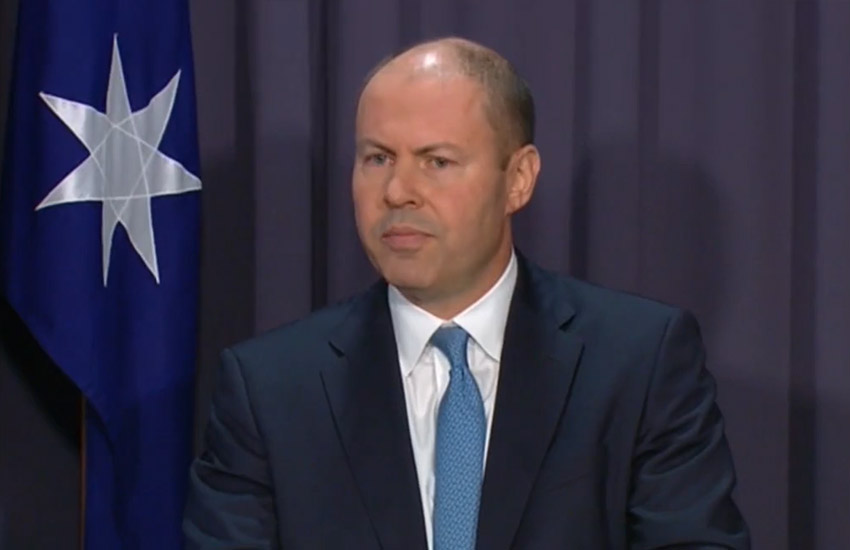

Treasurer Josh Frydenberg on Monday announced that the government would consult on how trusts are treated under insolvency law, with a view of ensuring small businesses who commonly use these structures are not disadvantaged.

Insolvent trading safe-harbour provisions, introduced in 2017, will also be reviewed to ensure they remain fit for purpose.

The government will also consult on the introduction of a moratorium on creditor enforcement while schemes of arrangement are being negotiated.

The threshold at which creditors can issue a statutory demand on a company will double from $2,000 to $4,000. The increase comes after the Treasury’s consultation on the matter in February hinted at a possible rise to $10,000 to align it with the personal bankruptcy threshold.

The announcements will be contained in the government’s 11 May federal budget.

“As Australia’s economy rebuilds, it’s important that as many businesses as possible have the opportunity to turn around, restructure and survive,” Mr Frydenberg said.

“That’s why the Morrison government is committed to building on our already significant insolvency reforms, keeping more businesses in business and driving Australia’s economic growth.”

The latest measures come after changes to Australia’s insolvency framework — billed as the largest reforms in 30 years — kicked in on 1 January.

The reforms mean small businesses experiencing financial distress could access a simplified debt restructuring process with the help of a small business restructuring practitioner, or enter into a simplified liquidation pathway to allow for a faster and lower-cost liquidation process. The temporary restructuring relief ended on 31 March.

ASIC’s list of published notices reveals that just 37 companies have made a declaration of their eligibility for the temporary restructuring relief.

According to the government, the rate of insolvencies remains around 40 per cent lower than pre-COVID levels.