TPB issues reminder over PI insurance

BusinessThe Tax Practitioners Board is set to contact practitioners who have not updated their professional indemnity insurance details, following several law changes that kicked in over the new year.

Early last year, the TPB temporarily waived the requirement to complete annual declarations if they were due on or before 30 June 2021, in response to the COVID-19 pandemic.

Practitioners, however, were still required to meet their obligations around professional indemnity insurance, fit and proper requirements and personal tax obligations.

In a recent online update, the TPB said it would now reach out to practitioners who had not updated their PI insurance details with the regulator.

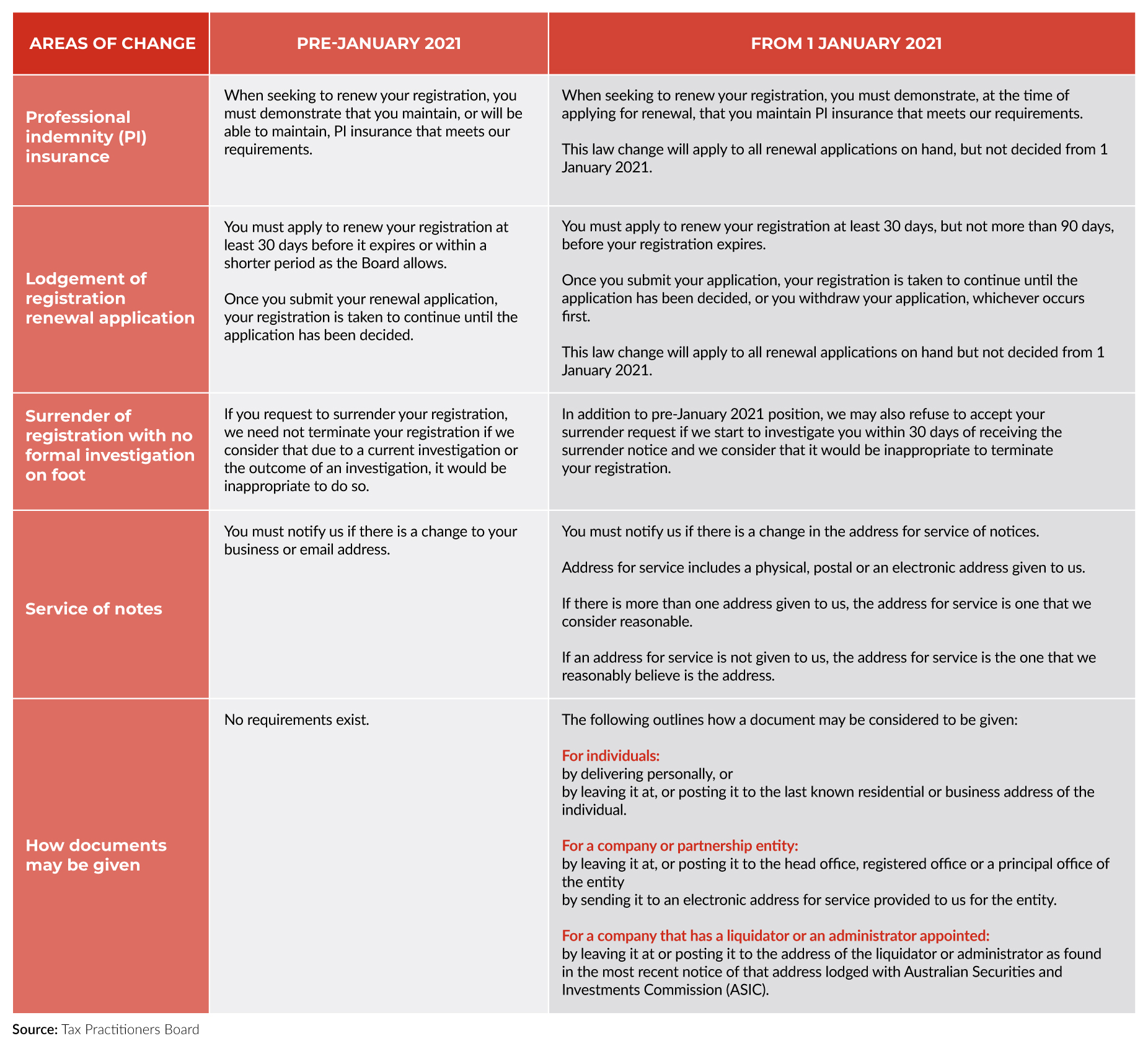

The reminder comes as several changes that impact PI insurance, registration renewal applications, surrender of registrations, address changes, and how documents may be given, have now kicked in.

The amendments to the Tax Agent Services Act were passed in June 2020 and took effect from 1 January 2021.