There is a new and easy way to grow Firm income by ceasing to offer audit insurance!

BusinessPromoted by Apxium.

Apxium Protect’s new Audit Safe service allows Firms to offer the same protection to clients and genuinely increase related fees three or four-fold (one firm increased their income 600%). Join the growing group of Accounting Firms that are disrupting the old-world audit insurance industry.

If your Firm offers audit insurance to Clients then you are almost certainly missing out on substantial income by not bringing the tax audit protection service in-house.

The idea of offering service cover instead of insurance to your clients is not completely new. Many accounting firms have been doing just that for many years. Now, with the help of the smart fully automated Apxium Protect Audit Safe service you can effortlessly bring the audit service offering in-house, providing a much better outcome for both your Clients and your Firm.

Many Accounting Firms have told us that they find the annual audit insurance offer process onerous and unnecessarily cumbersome. Apxium has worked with accountants to fully automate the process and make you and your team’s job very easy, every time.

You no longer need to share your client relationship with a third party, or endure the administratively time-consuming claims process, justifying the work you’ve done with timesheets. With Audit Safe you preserve your client relationship and the claims process is a thing of the past. The client is better educated about the risks and documentation requirements during an audit, retains an equivalent level of protection and receives a much better service offering to boot!

If you are currently utilising audit insurance, you know exactly how many of your clients are accepting the offer, how much insurance premium is collected by the audit insurer, how much of that goes to you in the form of a fee and how much you claim annually against any work done for audit purposes.

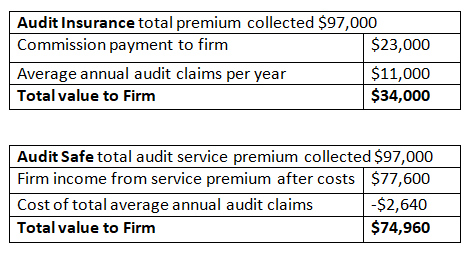

By way of comparison let’s look at the experience of an actual firm and compare the two financial outcomes (insurance vs Audit Safe).

This firm just made an additional $40,960 whilst their clients received a better service, including the same level of certainty and cover!

The mathematics of the proposition are simple. There is a large amount of value accruing to a third party via insurance premiums paid by YOUR clients.

Apxium Protect Audit Safe is the solution you need to both offer better service to your clients, significantly lower your administrative burden and substantially increase the benefit to your firm.

Apxium are experts at data integrating with accounting systems, as evidenced by their suite of products that are delivering substantial financial and operational savings while significantly improving your Firm’s debtor days.

Audit Safe is fully automated, will integrate with your underlying accounting system and pre-populate your cloud dashboard with all your clients, your client groups, and SMSF's. Additionally. Audit Safe will pre-populate the amount of cover and client pricing; this is easily edited by your administration team.

There is no paperwork, no manual invoicing and if any clients are audited (which we know is quite a rare occurrence) then there's no “claims process” to deal with. You get to completely manage the Client’s experience and needn’t send one justifying timesheet to anyone.

The implementation of Audit Safe couldn't be simpler. Apxium will integrate with your underlying invoicing system, build out your dashboard and present it to you in order for you to finalize your offer to clients. Once this is done, we manage the rest!

Contact us today and learn how Accountants are disrupting audit insurance whilst at the same time offering a significantly better service to their Clients and improving the bottom line of their business.

Click here to learn more, watch our video or sign up for a demonstration!

You are not authorised to post comments.

Comments will undergo moderation before they get published.