Industry mulls proposed penalty rate reversal

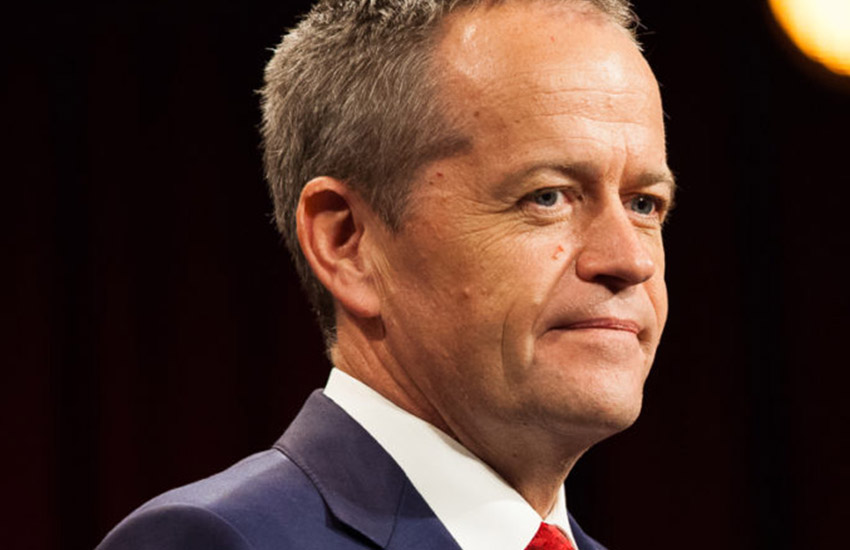

RegulationOpposition Leader Bill Shorten’s plan to restore weekend and public holiday penalty rates and to allow casuals a pathway to permanent employment has been met with scepticism from the bookkeeping industry.

Labor has promised to reverse penalty rate cuts for retail, fast food, restaurant, hospitality or pharmacy workers in its first 100 days in office if elected.

Speaking to The Bookkeeper, All That Counts director Lielette Calleja believes there needs to be flexibility in implementing penalty rates.

“Most small businesses want to do the right thing by their employees, but at what point is doing the right thing jeopardising more small business where we have no small business left to employ people?” Ms Calleja said.

“I have heard comments from people saying, ‘if you can’t afford to pay the rates then you shouldn’t be in business’. That is harsh and demoralising for business owners who are out there putting everything on the line to keep their doors open.

“Penalty rates need to come with a level of flexibility where the employer and employee can agree on what is fair and reasonable and formalise that. I am not suggesting for a minute that employees need to be worse off, but reality is, if you choose to work in a sector that is open for trade seven days a week and your shift falls on the weekend, then common sense tells me that is your normal working hours.”

Labor has also proposed an easier pathway for casuals to convert to permanent work, if they have worked regularly for the same employer over 12 months.

Casuals will be allowed the right to challenge an employer who “unreasonably refuses such a request”.

The proposal is built on the Fair Work Commission’s ruling that long-term casuals can request part-time or full-time employment.