ABN renewal requirements welcomed, details called for

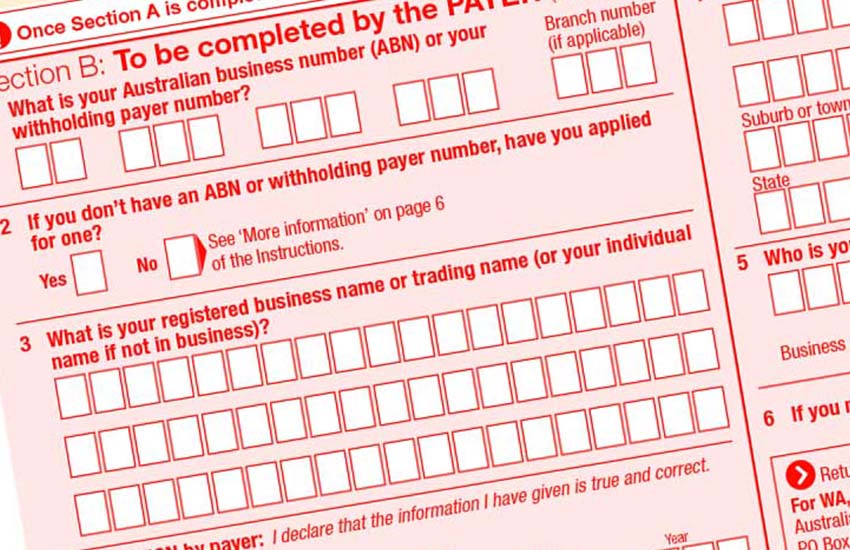

RegulationThe government has been called to release details on how it aims to introduce new ABN requirements to ensure details are current.

On Tuesday, Treasurer Josh Frydenberg announced that ABN holders will be required to lodge their income tax return and confirm the accuracy of their details on the ABR annually in order to maintain their ABN.

The income tax return condition will kick in from 1 July 2021, while the confirmation of details on the ABR will be imposed from 1 July 2022.

“While there may technically be a legal requirement for a business to keep their ABR information current, there has been no real incentive to do so and no easy way for a business nor their tax professionals to update this information,” Institute of Certified Bookkeepers executive chair Matthew Addison said.

“An annual update requirement that does not have a fee attached is a reasonable step as long as it is an easy update service.

“The preference would be an online service using contemporary proof of identity techniques that allow quick verification and confirmation by authorised persons or their agents.”

This measure is estimated to have a gain to the budget of $22.2 million over the forward estimates period.