Carbon Accounting is here. What does this mean for your firm?

TechnologyHear from 80+ industry leaders at Accountex Australia’s CPD accredited program, with sessions curated to meet the needs of all sizes of firms, SMEs, bookkeepers and sole traders.

Article written and interview conducted by SHOLTO MACPHERSON, Editor at Digital First.

The fight against human-driven climate change has largely focused on the transition of our fossil fueled energy industry to cleaner sources. But now every business is about to be thrown into the frontline.

Carbon management accounting is a very new field. So new that accounting firms are only now testing out carbon management calculators, establishing their own emission baselines and reviewing how they will supply a similar service to their clients.

Emissions management may not be what accountants signed up for, but they will most likely be the ones to do it, says Amanda Kenafake, CEO of Power Tynan, a 60-staff accounting firm in Toowoomba, Queensland.

In fact, some are billing the moment as GST 2.0 – an extension of the quarterly BAS that every business will need to fulfil.

Power Tynan has joined forces with an emissions management company called Natural Capital Co that focuses on the agricultural industry. Farmers have a range of options when it comes to climate change including land sequestration and land regeneration, soil tests, tree carbon, savannah burning and marine credits.

Cattle farms are also quite exposed; cows emit large quantities of methane, a gas that is highly destructive to the ozone layer.

“A lot of ag companies probably don’t think they need to worry about ESG,” Kenafake says. However, Coles and Woolworths have declared “net zero” goals which includes their supply chains. “These guys in some way are going to get forced into it. I’m just trying to help navigate that world, which is difficult at the moment because it’s all pretty new and unstructured.”

Now is the time to understand carbon management accounting

Firms which have moved early on carbon management accounting have found themselves well ahead of the curve. A Tasmanian firm Ellis Richmond launched only two years ago to focus on the mining industry. However, its clients wanted more than compliance. The miners wanted the firm to conduct emissions assessments.

Within a year the firm had produced 50 assessments and hired 20 staff. The firm faced a clear choice, says Jessica Richmond, who was a partner at the time. It could either become a boutique firm in carbon management accounting, or it could create a separate business helping other accounting firms do the same.

Richmond took her experience with the miners to create reporting platform Local Carbon, which supports accountants that want to help clients measure and reduce their carbon footprints.

“If SMBs are going to reduce emissions, they’re generally going to be spending money or time or changing an operational practice. And most of the time that requires a business case and advisory work,” Richmond says. “The return on those decisions needs to be well understood. Did those decisions move the dial? And am I actually on the pathway I need to be to meet the targets set by my business or industry or country?”

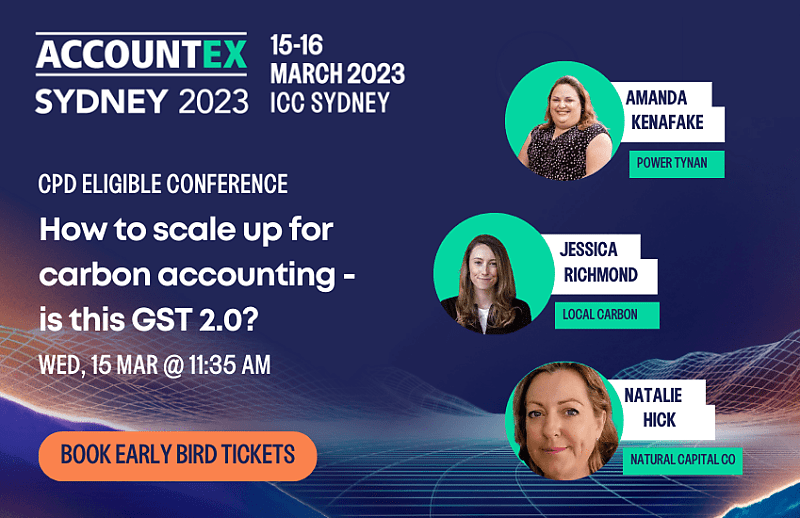

Power Tynan’s Amanda Kenafake, Local Carbon CEO Jessica Richmond and Natural Capital Co’s MD Natalie Hick will discuss how firms will expand to deliver carbon management accounting. The panel will address how much work is involved in emissions measurement, the skills required and how it fits within the broader ESG reporting framework.

The panel session “How to scale up for carbon accounting – Is this GST 2.0?” will take place on the main stage at the Accountex Australia on 15-16 March 2023 at the ICC Sydney.

Early Bird tickets are on sale now! Check out the full program and secure your spot today. Don’t forget you can also earn CPD points by attending any of the sessions.

You are not authorised to post comments.

Comments will undergo moderation before they get published.