How to do a pre-tax season process check

TaxPromoted by Receipt Bank.

With tax season approaching, now’s the time to prepare your firm to meet the challenges head-on. Here are 3 steps to get yours ready.

As your firm braces for tax season, it is crucial to have efficient processes in place. According to Gary Boomer, “a process is an organised group of related activities that together create value to clients. No single task creates the desired value. Value is created by the entire process.” It takes planning, a clear sense of your desired outcome, thoughtful documentation and regular reviews.

STEP ONE: ANALYSE YOUR PROCESS

It’s easy to get lost in the day-to-day running of a firm. Between going above and beyond for your clients, handling last-minute requests and meeting tight client deadlines, there’s often not enough time to step back and plan ahead.

Consider setting an hour aside to review your current process. You’ll need somewhere quiet, a pack of post-it notes, pens in different colours, and a desk or table. Ironically, the route to going paperless with cloud technology often starts on paper.

- First, pick a process and outcome you want to understand in detail. For instance, let’s focus on pre-accounting.

- Write down every step involved, using a post-it note for each step.

- Then, in a different colour pen, write down how long each step takes in minutes, hours or days.

- Add what business functions or team members are involved in another colour.

- How does this step impact the total cost and quality of your pre-accounting?

- How can you improve each one? Could you change the way you source documents, or perhaps even eliminate a step completely?

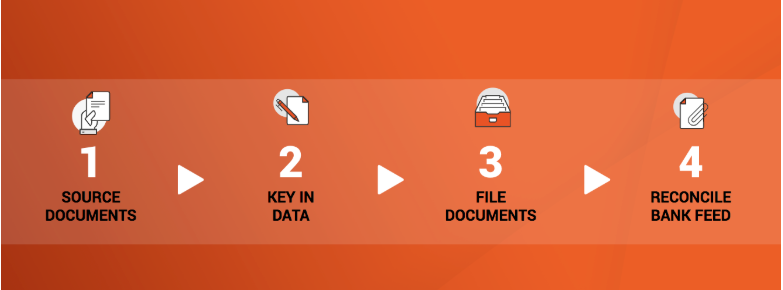

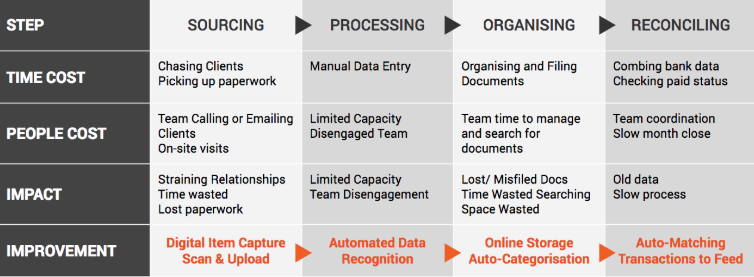

Here’s an example of how you can maximise your efficiency and enhance your traditional workflow.

If you are currently picking up receipts, bills and invoices from your clients in person, you could save hours a week by using Receipt Bank. It saves your clients time and money, plus office space where they would otherwise store physical paperwork.

Furthermore, if you type in data from paperwork by hand, technology could do this heavy-lifting for you. By using Receipt Bank, you then have secure cloud storage for seven years plus an easily searchable database. Instead of searching through files of paper, you can type in a document name and locate it instantly.

Crucially, with any new technology, it’s about the value you give to clients. If you choose to change or refine your current process, you must first communicate with your clients.

STEP TWO: TALK TO CLIENTS

Your clients work with you for a reason. You make their lives easier, enable them to run their businesses more efficiently and ensure compliance. How will a new and improved process enhance your client experience?

- Arrange a client meeting well in advance of tax season, when your time will be at a premium.

- Establish upfront why you will be scheduling a meeting, whether face-to-face or remotely, and emphasise the benefits of a digital process. For your client, it’s quicker, easier and more secure than traditional methods. Plus, it gives you close to real-time data. If you choose to, you can also discuss how this can support strategic planning and data-driven decision-making.

- Then, show how the new technology works. With Receipt Bank, this is easy. If you’re meeting your client in person, treat them to a coffee, then take a photo of the receipt using the mobile app. Receipt Bank partners worldwide even use this as a marketing tool for potential clients.

STEP THREE: TEST YOUR PROCESS

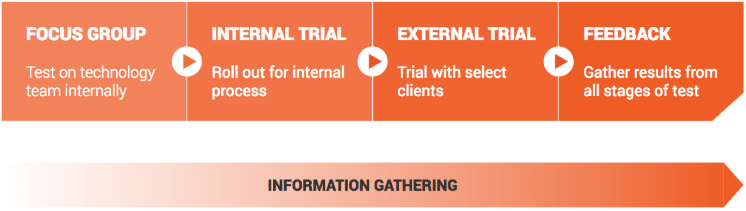

After you confirm your new process, measure success in three steps:

- Gather feedback from your team, in person or online through a form like Google Forms or Typeform.

- Monitor improvement goals. What value did you set out to achieve? Have you met it? You may find unexpected benefits to the new process.

- Test new approaches to reaching them. Every firm is different. You may find that different approaches resonate more effectively with your client-base.

Ultimately, when you plan with innovation, creativity and thoughtfulness, you can deliver a stand-out client experience all while improving your work/life balance, productivity and team happiness. It’s all there for the taking.

Learn more about how Receipt Bank can help you drop the data entry and go paperless. Visit receipt-bank.com/gift100 to find out more.

You are not authorised to post comments.

Comments will undergo moderation before they get published.