QuickBooks Content Connection

Dedicated resources, inspiring stories and the latest industry news & views

EXPLORE NOWIs your business ready for the digital transition? STP tips from QuickBooks experts

As of this month, over 100,000 businesses Australia-wide are using payroll or accounting software to report their tax and super information to the ATO.

Are you ready for the digital transition? STP tips from our experts

With 1 July just around the corner, small businesses are readying themselves for the start of single touch payroll (STP).

As of this month, over 100,000 businesses Australia-wide are using payroll or accounting software to report their tax and super information to the ATO.

This means that some 6.5 million employees now have payment summary information available to them through myGov.

Lielette Calleja, the director of All that Counts; Bianca Bowron-Cuthill from Intuit QuickBooks; and John Shepherd, assistant commissioner at the ATO, recently joined head of editorial at Momentum Media, Katarina Taurian, for an exclusive MyBusiness webcast outlining the process Australian businesses will be required to implement in the coming weeks.

We bring you the top five takeaways.

1. STP a by-product of digitisation

Small businesses operating from a shoebox are being nudged to slowly transition to digital. STP allows these businesses to leverage the opportunity and take their business to the cloud.

Ms Bowron-Cuthill explains that despite sounding complicated, becoming STP enabled is a fairly simple task.

“As soon as businesses understand that there is a need for them to change, what we are seeing is that a number of them are looking at taking their whole business digital,” Ms Bowron-Cuthill says.

“The perception is that it is a big daunting task, but it’s actually quite simple.”

Once you have chosen your preferred software, migrating your clients to the cloud can be as easy as 1, 2, 3.

Ms Bowron-Cuthill reminds businesses that the old way of storing data is risky. With QuickBooks Online you don’t have to worry about computers dying, getting stolen or misbehaving, all of your data will be in the cloud, she says.

2. Spreadsheets are not ‘real time’

Wage books and excel spreadsheets are not in real time, cautions Ms Calleja. This means that businesses still operating on old methods don’t have access to their numbers.

“It is very disjointed and you have some people operating their payroll system outside of an accounting system, or their accounting system is their bank statement. They hand that over to their accountant to do their BAS,” says Ms Calleja.

“They only see bookkeeping as a form of compliance and I think STP changes that whole shift.”

The digital solution gives businesses an insight into their profitability in real time and provides them with a chance at a more balanced lifestyle.

“You can do things on your mobile. You don’t have to wait until you are at home or in your office. I am a huge advocate,” Ms Calleja admits.

3. Making the transition

There are around 700,000 small employers yet to embrace digital payroll, Mr Shepherd reveals.

He notes that the ATO is aware that not everyone is ready for 1 July; hence it has come up with several transition arrangements.

Mr Shepherd reiterates that employers can actually start reporting any time from 1 July to 30 September.

But despite the buffer, the panellists agree that businesses should be wary of becoming complacent.

However, if businesses feel they are unable to make the September deadline, a special range of deferrals and exemptions will be available subject to certain conditions, Mr Shepherd adds.

Employers and their agents can learn more information on STP deferrals and exemptions solutions on ato.gov.au.

4. Time required to implement STP

Businesses already in possession of a cloud product that has the ability to transition to STP will have a quick and easy journey to digital reporting.

But despite the alleviating circumstances, they should focus on transitioning to digital as soon as possible, says Ms Bowron-Cuthill.

“No small business wants to leave the biggest ‘change’ to the end of the financial year. But once you do make that decision, whether you decide to go with QuickBooks Online or any other software solution, it is actually quite simple,” she says.

“You can sign up for a service online or if you are migrating existing data from a solution you are reusing, we have all those different migration services available.”

The time and money put into the implementation of STP will pay out in the future, Ms Calleja clarifies.

“You invest the time upfront to gain time in the future. A subscription cost of $120 a year for a solution that is going to give you so many more benefits to run your business and give you the numbers and the resources. If you can’t afford that, then maybe you shouldn’t be in business,” Ms Calleja states.

She adds that these are the things you need to factor in when you go into business.

5. Talk to your accountant

Accountants and bookkeepers can train small businesses to take full ownership of STP.

However, small businesses should not assume that their accountants and bookkeepers are on top of the switch to digital.

“Don’t make assumptions, pick up the phone, send an email, ask them ‘are you on top of it, do I need to do anything?’,” Ms Calleja advises.

She says businesses must be proactive and take charge in becoming digital.

Ms Bowron-Cuthill explains that having spoken to several accountants, she found that while some are readying themselves for STP on their clients’ behalf, others are stepping aside and letting their clients take charge.

“As a small business owner, it is ultimately the small business’ responsibility. It is not the responsibility of the bookkeeper or their accountant,” Ms Bowron-Cuthill says.

“If you haven’t had that conversation with your adviser, if you do work with a trusted adviser, I would have that now or start that search to make sure you are making that decision on your own behalf in terms of what steps you need to take in order to be STP compliant.”

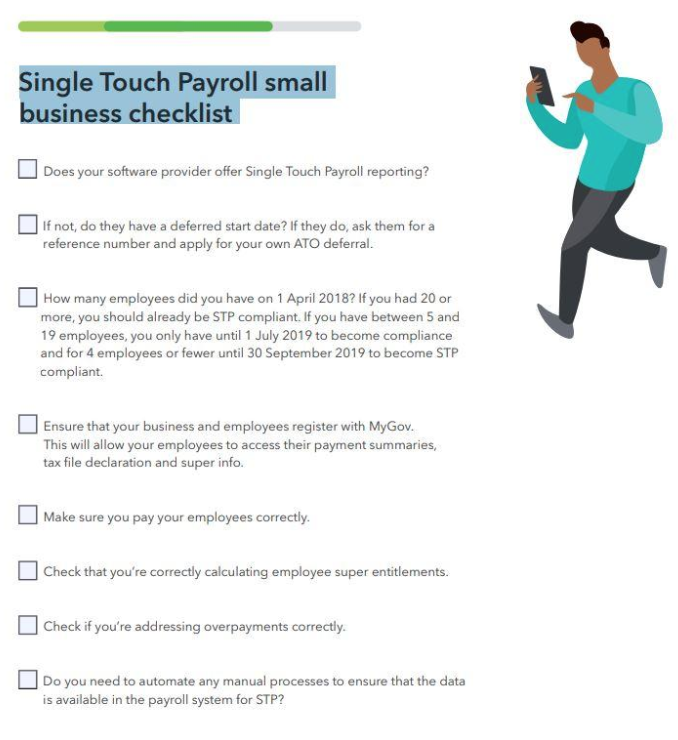

Need further support? Here is a single touch payroll small business checklist to help you ensure a smooth transition.

Want more time to work on, not in, your practice?

Leave your details to get access to a range of time saving tools from Intuit QuickBooks.Latest Articles