Payment transparency laws set to hit big business

BusinessOver 2,000 businesses could be made to report their payment times to small businesses under new laws proposed by the government.

The federal government has opened consultation on the draft Payment Times Reporting Framework, which would see businesses with over $100 million in annual turnover publish information on their SME payment times and practices.

Approximately 2,500 businesses will be affected, including government corporate entities and foreign companies.

The legislation is proposed to take effect from 1 January 2021 and would require large businesses to report within three months after the end of a six-month reporting period.

If the framework passes, large businesses will be required to report how quickly they say they will pay their SME suppliers and how quickly they actually pay.

The payment times reporting information will be made available on a public website for small businesses and other interested stakeholders.

In addition, large businesses will be required to report if and how often they use supply chain financing arrangements where an SME can accept a reduced payment to be paid quicker.

Reports would be made to a proposed Payment Times Reporting Regulator twice a year, with the six months they use to report being based on the financial year a business uses for tax purposes.

Non-compliance with the framework could see businesses penalised daily with penalty units.

Failure to report, notify the regulator of changes and comply with a notice of audit would incur 60 penalty units for an individual and 300 penalty units for a body corporate for each day of non-compliance.

Failure to provide an auditor with assistance and keep records would see a civil penalty of up to 200 penalty units for an individual or up to 0.2 of a percentage point of annual turnover for a body corporate.

The Australian Small Business and Family Enterprise Ombudsman (ASBFEO), Kate Carnell, has welcomed the framework and its potential impact on cash flow for small businesses.

The draft framework comes after the ASBFEO found that Australian and multinational companies are increasingly delaying or extending payments to their small business suppliers from 30 days to 45, 60, 90 or 120 days.

“This framework will require big businesses to be upfront and honest about the time it takes to pay small businesses, to help small businesses choose who they supply,” Ms Carnell said.

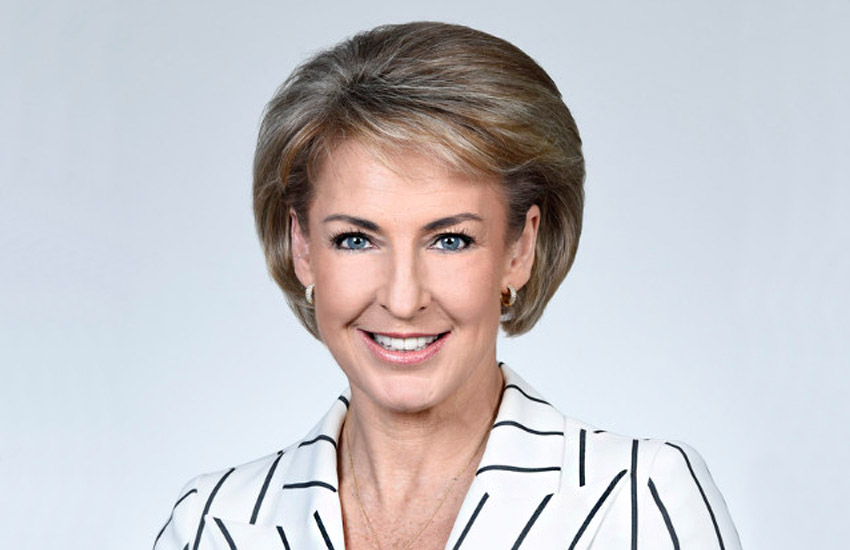

Minister for Employment, Skills, Small and Family Business Michaelia Cash said the new framework is essential to encourage fairer and faster payments.

“Slow or deliberately delayed payment times have a significant impact on small business cash flow and viability,” Ms Cash said.

“Big businesses pay their small business suppliers late more than 50 per cent of the time.”

The draft also proposes that all reports will be displayed on a public website to increase transparency on how quickly large businesses pay their SME suppliers.

Consultation on the draft framework is open until 6 March 2020.