Budget Week

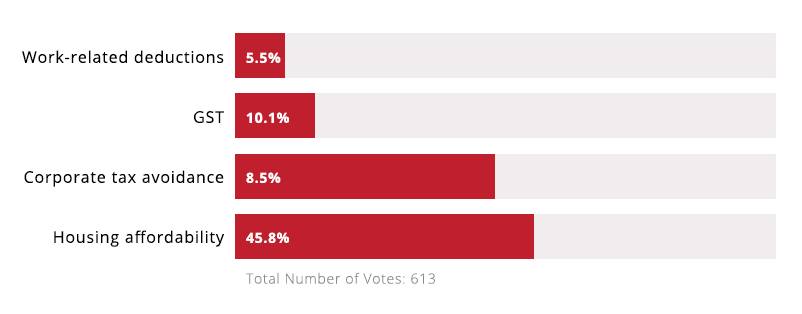

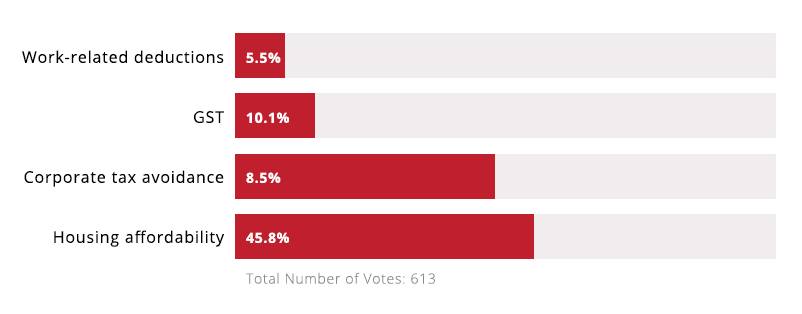

"What would you like to see in the 2018 federal Budget for tax?"

Tax experts reveal their tax reform wish list for the 2018 Federal Budget which includes areas such as GST, fringe benefits tax, the CGT discount and the small business immediate asset write off. Overall, the accounting industry would like to see a move towards a simpler and more efficient tax system.

Brad Eppingstall, director, RSM Australia

Brad Eppingstall, director, RSM AustraliaFirstly, nothing in relation to superannuation other than the already announced expansion of SMSF membership to a maximum of six members. The July 2017 reforms are still being implemented and bedded down now. The last thing we need is more reform. It is time to provide some stability and confidence in the superannuation system and take the time to assess the impact of the last reforms on the system.

From a business perspective I would like to see a plan for comprehensive tax reform. Not the tinkering we see with the system on an annual basis at budget time, but genuine reform of the taxation system. This would include a review and reform of all taxes, including GST in terms of the rate and the current exemptions. A comprehensive reform of the system would aim to encourage investment in businesses and encourage employment growth.

Small businesses currently wait every year to see whether the immediate asset write off threshold will remain at the current $20,000 limit or will it revert to the previous limit of $1,000. I hope that the budget this year will commit to the ongoing threshold being $20,000.

Timothy Munro, managing director, Change Accountants & Advisers

Timothy Munro, managing director, Change Accountants & AdvisersIf I was to focus on one tax that is an administrative nightmare and a complete waste of time, it would be Fringe Benefits Tax (FBT).

The tax revenue gain for the time and effort involved (by accountants, clients and the ATO) must surely be negligible.

Let’s reform FBT this way and make things incredibly simple: Any benefit / cost / expense paid by an employer that is not taxed via the PAYG system is not tax deductible to the employer. Simple. Easy. No FBT Return needed./p>

One expense I would make immediately tax deductible is entertainment.

Business lunches and dinners are where deals are done. We need more of this to get the cash cycle moving again across Australia.

Think of the additional people that would be employed everywhere by cafes and restaurants. Other local businesses would then also benefit.

Professor Robert Deutsch, senior tax counsel, Tax Institute

Professor Robert Deutsch, senior tax counsel, Tax InstituteThere are a number of possibilities which could be adopted to promote a more efficient and simpler tax system. Three key measures we are regularly advocating for reform for the tax system are: Standardising tax rates and brackets; abolishing the Fringe Benefits Tax, Medicare levy, and surcharge, and simply making them part of the overall income tax that is currently collected from taxpayers; and expanding the scope of GST by eliminating the GST free categories for basic food, health and education with up to half the tax saved being used to compensate lower paid income earners and pensioners for the additional cost of living.

These measures will have major impacts, both negative and positive, but would reduce complexity in the tax system, without compromising equity between taxpayers.

Simon Dorevitch, assistant manager, A&A Tax Legal Consulting

Simon Dorevitch, assistant manager, A&A Tax Legal ConsultingA good tax is one that is fair - imposing a higher burden on those with greater means to pay, efficient - imposing minimal distortions to the operation of the free market and simple - imposing minimal costs (in terms of time and advisor fees) on taxpayers. The CGT discount (and in particular the level it is set at) may be simple, but it is also too generous and, as a result, fails the first two of those tests miserably.

Capital gains are disproportionately made by wealthier Australians (who are more likely to have surplus funds to invest) and therefore they receive a disproportionate share of the benefits of the discount. This is illustrated by the fact that the two electorates that benefited most from the discount encompass Point Piper in Sydney and Toorak in Melbourne. I think that government funds could be better spent.

Furthermore, the CGT discount encourages taxpayers to structure their affairs in a way that favours capital investment over actions or investments that lead to other forms of income. When combined with negative gearing, this is a key driver of Australia’s red-hot property market. While there are good reasons to encourage investment, I don’t believe they are sufficient to justify a 50% discount after only 12 months.

How would I reform the CGT discount? There are a number of good options but one to consider would be to bring in a rough approximation of indexation. Apply the discount to capital gains at the rate of 5% per full year that the CGT asset is held, capped at 50% after 10 years. I believe would strike the right balance between encouraging investment without distorting the market too much or providing a free kick to those who need it least.

"Are you confident superannuation changes will be off the table in the 2018 federal budget"

{loadmodule mod_relatedbudget, Related Budget}

"What would you like to see in the 2018 federal Budget for tax?"

Tax experts reveal their tax reform wish list for the 2018 Federal Budget which includes areas such as GST, fringe benefits tax, the CGT discount and the small business immediate asset write off. Overall, the accounting industry would like to see a move towards a simpler and more efficient tax system.

Brad Eppingstall, director, RSM Australia

Brad Eppingstall, director, RSM AustraliaFirstly, nothing in relation to superannuation other than the already announced expansion of SMSF membership to a maximum of six members. The July 2017 reforms are still being implemented and bedded down now. The last thing we need is more reform. It is time to provide some stability and confidence in the superannuation system and take the time to assess the impact of the last reforms on the system.

From a business perspective I would like to see a plan for comprehensive tax reform. Not the tinkering we see with the system on an annual basis at budget time, but genuine reform of the taxation system. This would include a review and reform of all taxes, including GST in terms of the rate and the current exemptions. A comprehensive reform of the system would aim to encourage investment in businesses and encourage employment growth.

Small businesses currently wait every year to see whether the immediate asset write off threshold will remain at the current $20,000 limit or will it revert to the previous limit of $1,000. I hope that the budget this year will commit to the ongoing threshold being $20,000.

Timothy Munro, managing director, Change Accountants & Advisers

Timothy Munro, managing director, Change Accountants & AdvisersIf I was to focus on one tax that is an administrative nightmare and a complete waste of time, it would be Fringe Benefits Tax (FBT).

The tax revenue gain for the time and effort involved (by accountants, clients and the ATO) must surely be negligible.

Let’s reform FBT this way and make things incredibly simple: Any benefit / cost / expense paid by an employer that is not taxed via the PAYG system is not tax deductible to the employer. Simple. Easy. No FBT Return needed./p>

One expense I would make immediately tax deductible is entertainment.

Business lunches and dinners are where deals are done. We need more of this to get the cash cycle moving again across Australia.

Think of the additional people that would be employed everywhere by cafes and restaurants. Other local businesses would then also benefit.

Professor Robert Deutsch, senior tax counsel, Tax Institute

Professor Robert Deutsch, senior tax counsel, Tax InstituteThere are a number of possibilities which could be adopted to promote a more efficient and simpler tax system. Three key measures we are regularly advocating for reform for the tax system are: Standardising tax rates and brackets; abolishing the Fringe Benefits Tax, Medicare levy, and surcharge, and simply making them part of the overall income tax that is currently collected from taxpayers; and expanding the scope of GST by eliminating the GST free categories for basic food, health and education with up to half the tax saved being used to compensate lower paid income earners and pensioners for the additional cost of living.

These measures will have major impacts, both negative and positive, but would reduce complexity in the tax system, without compromising equity between taxpayers.

Simon Dorevitch, assistant manager, A&A Tax Legal Consulting

Simon Dorevitch, assistant manager, A&A Tax Legal ConsultingA good tax is one that is fair - imposing a higher burden on those with greater means to pay, efficient - imposing minimal distortions to the operation of the free market and simple - imposing minimal costs (in terms of time and advisor fees) on taxpayers. The CGT discount (and in particular the level it is set at) may be simple, but it is also too generous and, as a result, fails the first two of those tests miserably.

Capital gains are disproportionately made by wealthier Australians (who are more likely to have surplus funds to invest) and therefore they receive a disproportionate share of the benefits of the discount. This is illustrated by the fact that the two electorates that benefited most from the discount encompass Point Piper in Sydney and Toorak in Melbourne. I think that government funds could be better spent.

Furthermore, the CGT discount encourages taxpayers to structure their affairs in a way that favours capital investment over actions or investments that lead to other forms of income. When combined with negative gearing, this is a key driver of Australia’s red-hot property market. While there are good reasons to encourage investment, I don’t believe they are sufficient to justify a 50% discount after only 12 months.

How would I reform the CGT discount? There are a number of good options but one to consider would be to bring in a rough approximation of indexation. Apply the discount to capital gains at the rate of 5% per full year that the CGT asset is held, capped at 50% after 10 years. I believe would strike the right balance between encouraging investment without distorting the market too much or providing a free kick to those who need it least.

"Are you confident superannuation changes will be off the table in the 2018 federal budget"