Last year was unlike any other for the accounting industry. We saw:

- An annual decrease in the total number of accounting firms for the first time in over 10 years (0.5 per cent decrease in total entities).

- The government began the biggest crackdown ever on tax adviser misconduct.

- The RBA hiked the cash rate at the steepest level since 1980.

Also, for the first time, businesses across the country we able to freely access generative AI to use on daily administrative tasks.

Additionally, we saw some continuing long-term trends right across the industry:

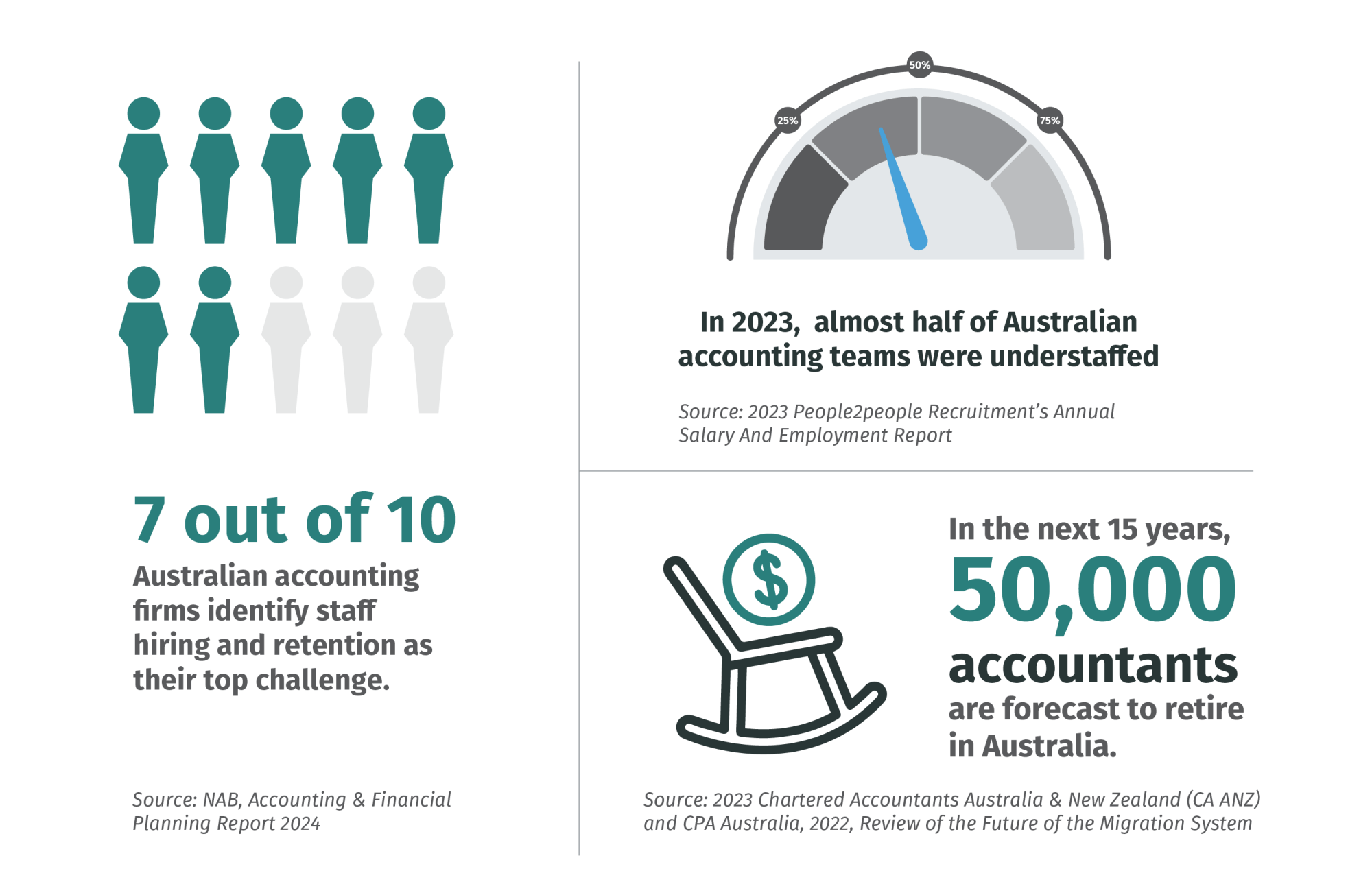

- The accountant shortage continued as firms struggled to attract and retain talent.

- The number of bookkeepers and payroll clerks decreased again, this time by almost 15 per cent.

- The number of auditors, company secretaries and corporate treasurers reached an all-time high of 15 per cent of all workers classified as accountants.

What’s in store?

Across the industry we are seeing slow, conservative changes across a range of areas. While they are not moving fast, the trends are there. The Benchmarking Group has analysed data and trends for 2024 in its Crunch Report. Here are the headlines.

AI and automation

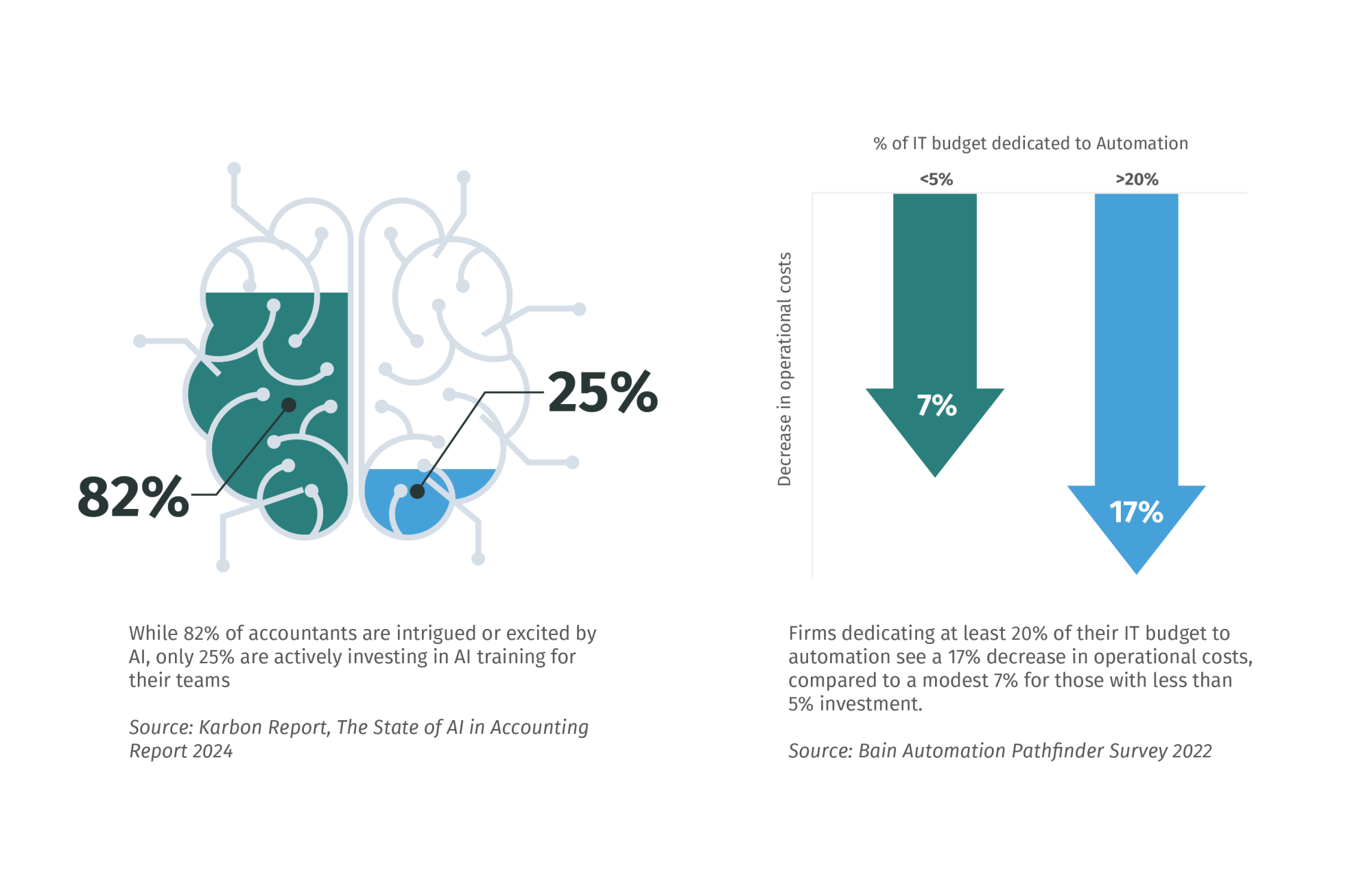

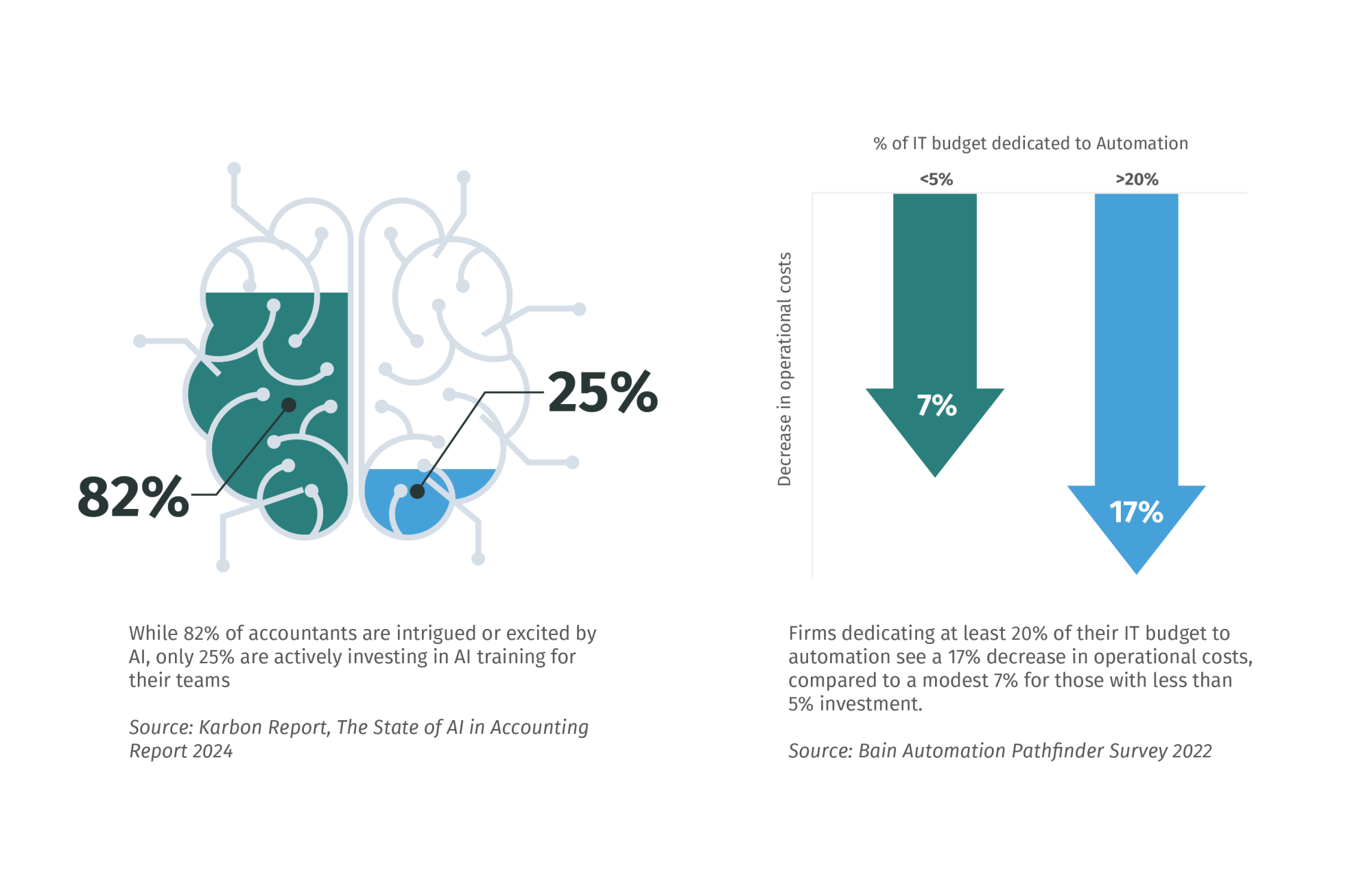

Research shows that while 82 per cent of accountants are intrigued or excited by AI, only 25 per cent are actively investing in AI training for their teams. This is reflective of the greater business market, where 85 per cent have no plan to use AI in the next six months.

Despite these numbers, we forecast more than 50 per cent of firms will start to adopt AI in some form this year. The majority are now using automation for at least some of their operations and this will grow as tech becomes more user intuitive and available.

The use of AI and automation may be driven more by the necessity to respond to the accountant shortage than a desire for change. Firms which can minimise administrative tasks of fee earners may be able to achieve more output with less workers.

Slow shift into accounting++

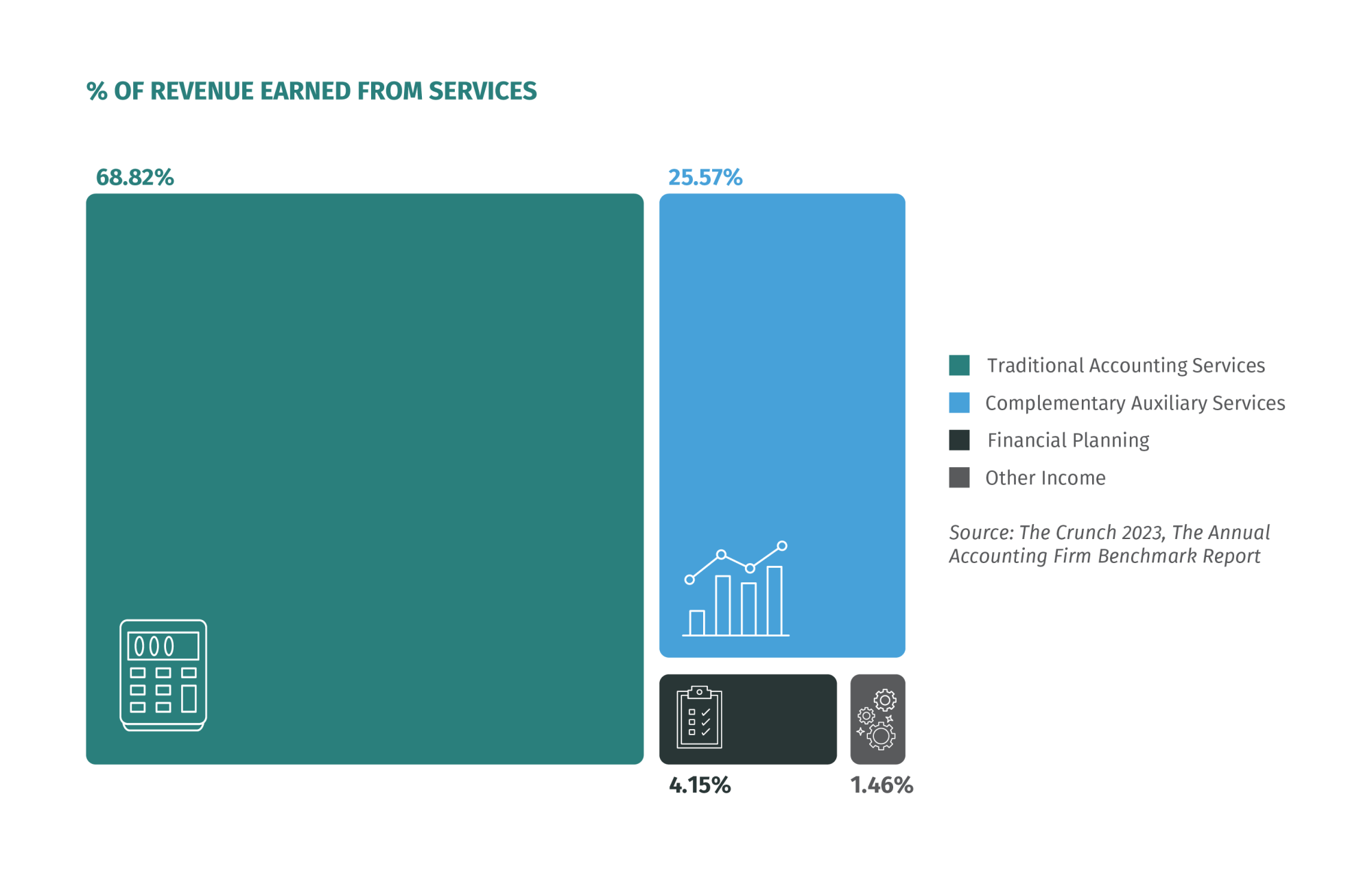

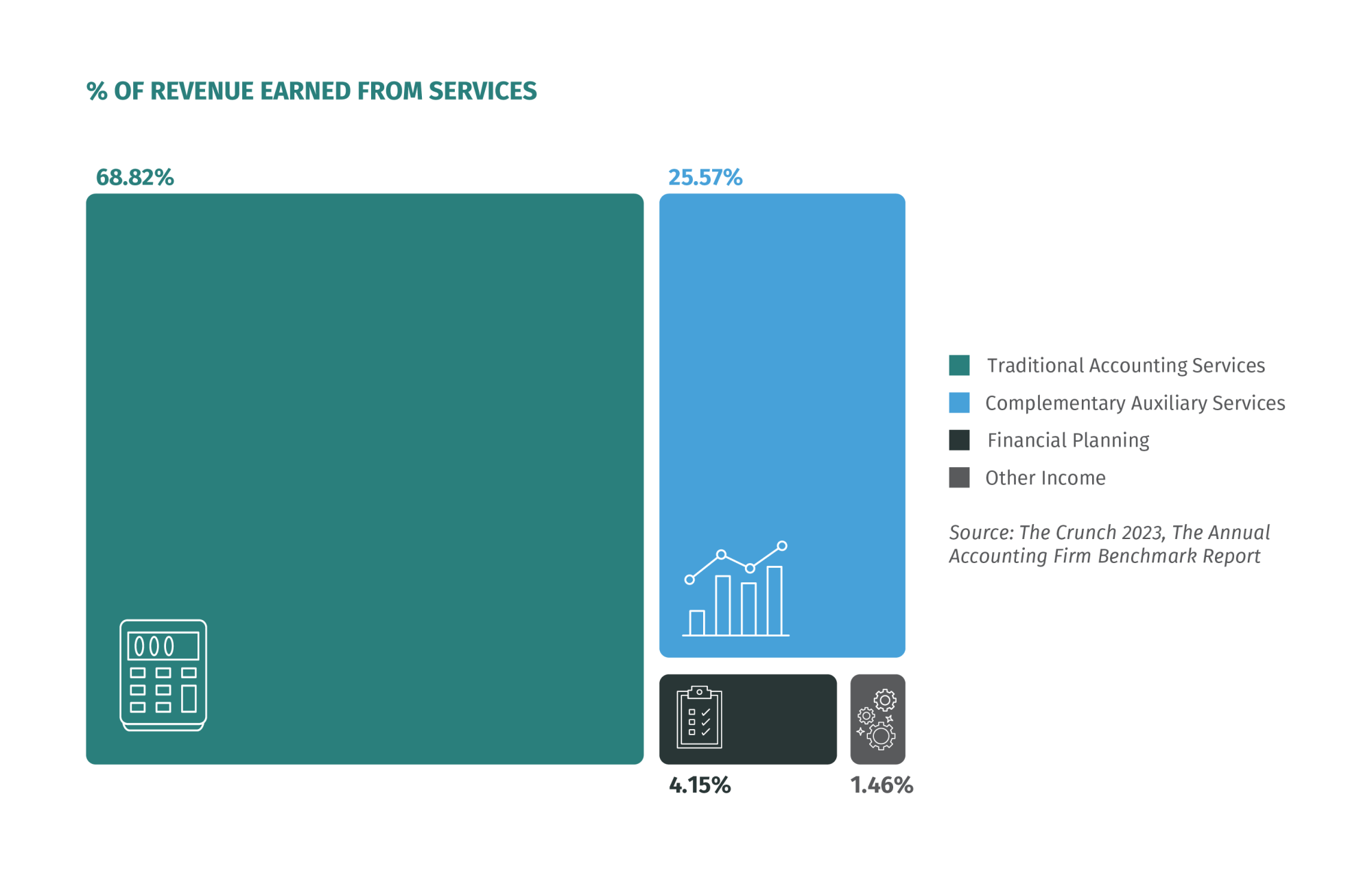

There is a gradual move towards firms offering more non-traditional accounting services. But it’s slow. A 2023 NAB report shows a 10 per cent increase in accounting firms offering business strategy services from 2018-23.

This shift is expected to increase slightly. Clients will demand more from their accountants, new tools will become available to streamline operations (increasing firm capacity), and the number of bookkeepers will decline.

Need to sustain the core

Despite the industry's slow shift towards accounting++, traditional services like compliance and auditing remain, and will continue to remain, indispensable. These services are projected to contribute significantly to firm revenues for at least another decade, if not longer.

Advances in technology should support accountants to streamline these services. However, a need for skilled accounting expertise will persist. It is forecast that it will be some time before automation replaces the fundamental requirements for professional judgement and expertise.

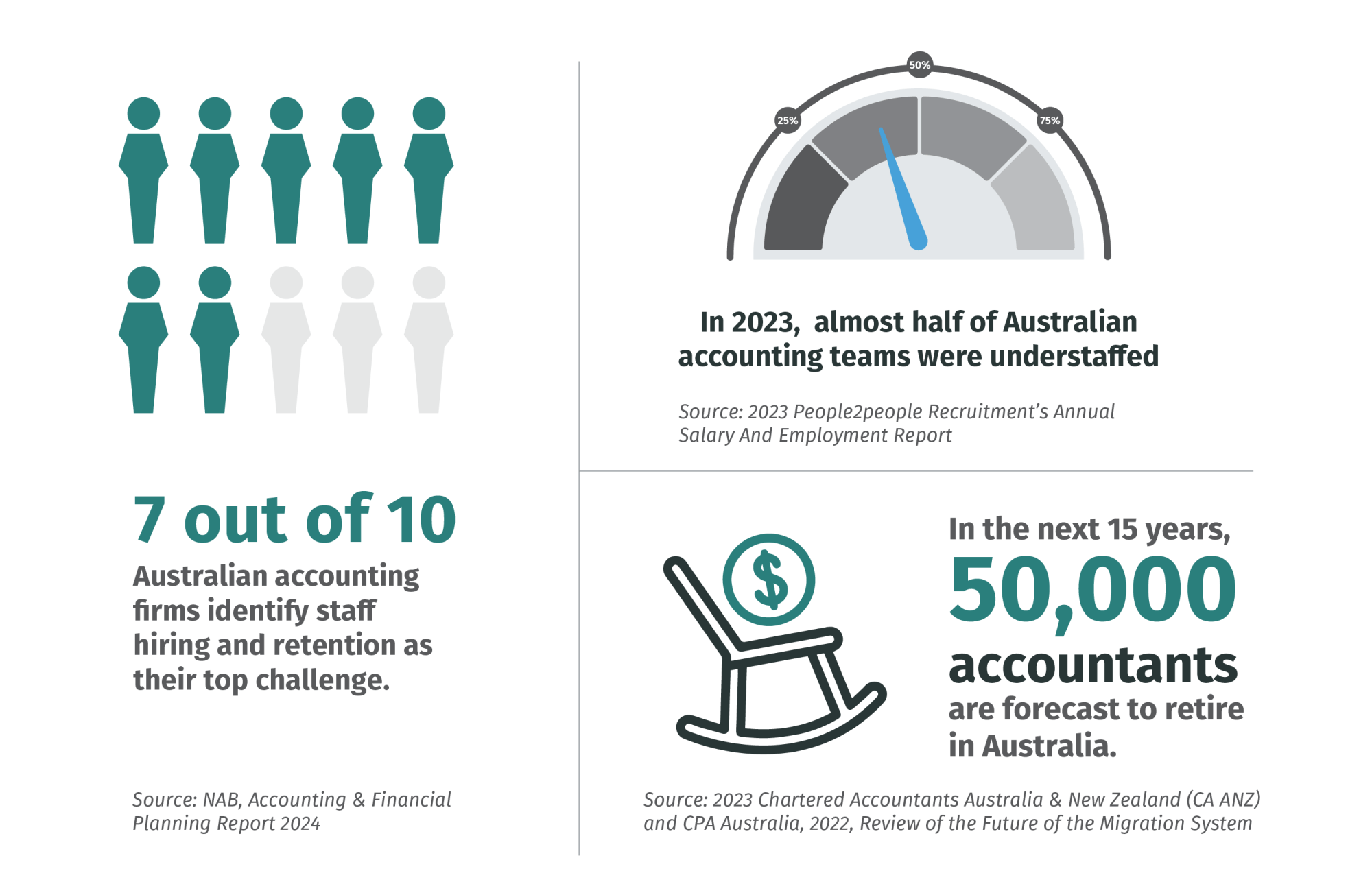

The accountant shortage is here to stay

Recruitment and retention remains top of the list of challenges for 2024. However, the industry faces a potentially larger problem: the total pool of available accountants. In the next 15 years, it is forecast that 50,000 accountants will retire. This is compounded by one in three accountants considering leaving the industry in the next five years.

Firms will need to attract younger staff by offering improved working conditions, flexible work arrangements and engaging tasks.

Mergers and acquisitions to rise

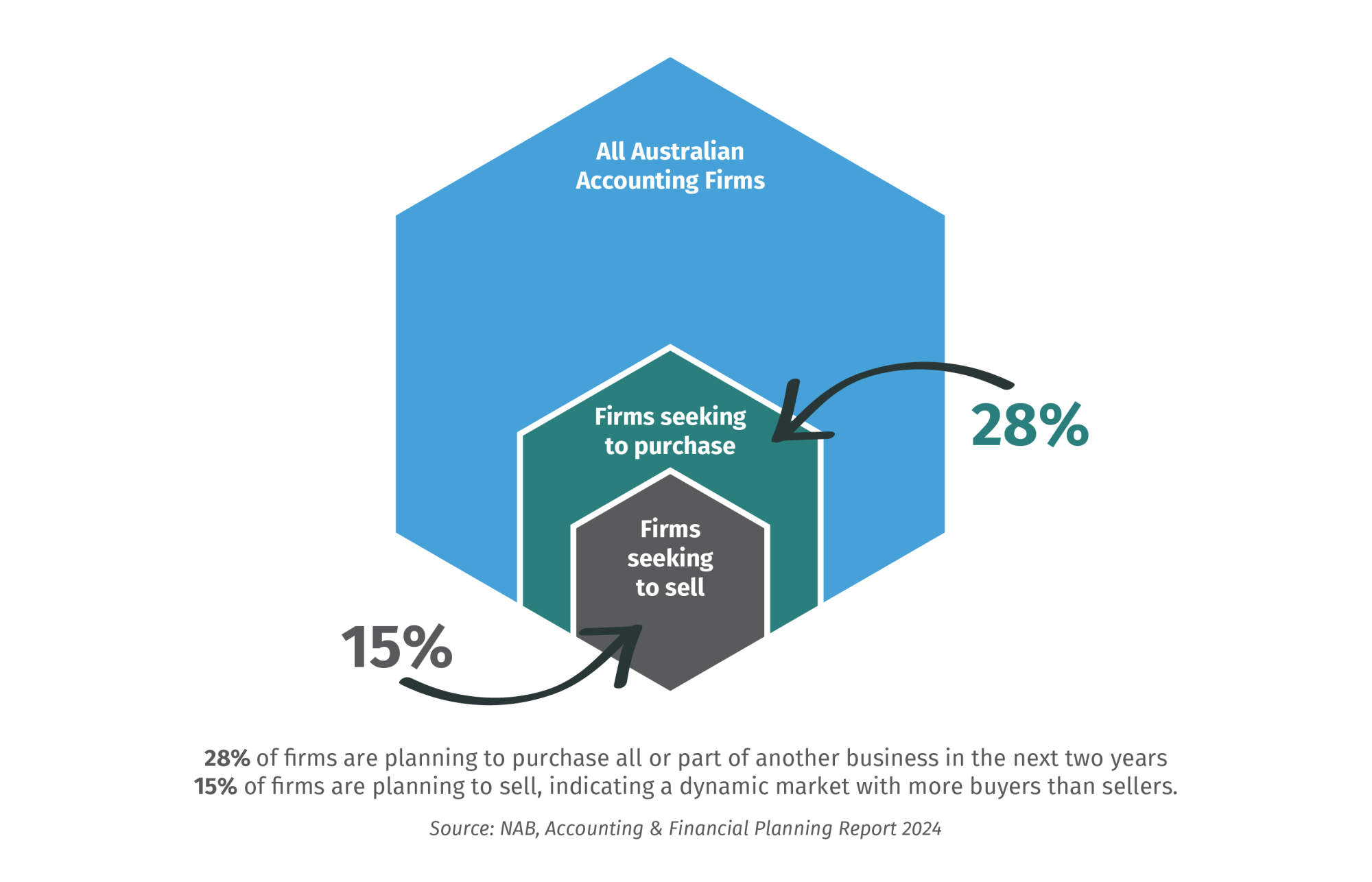

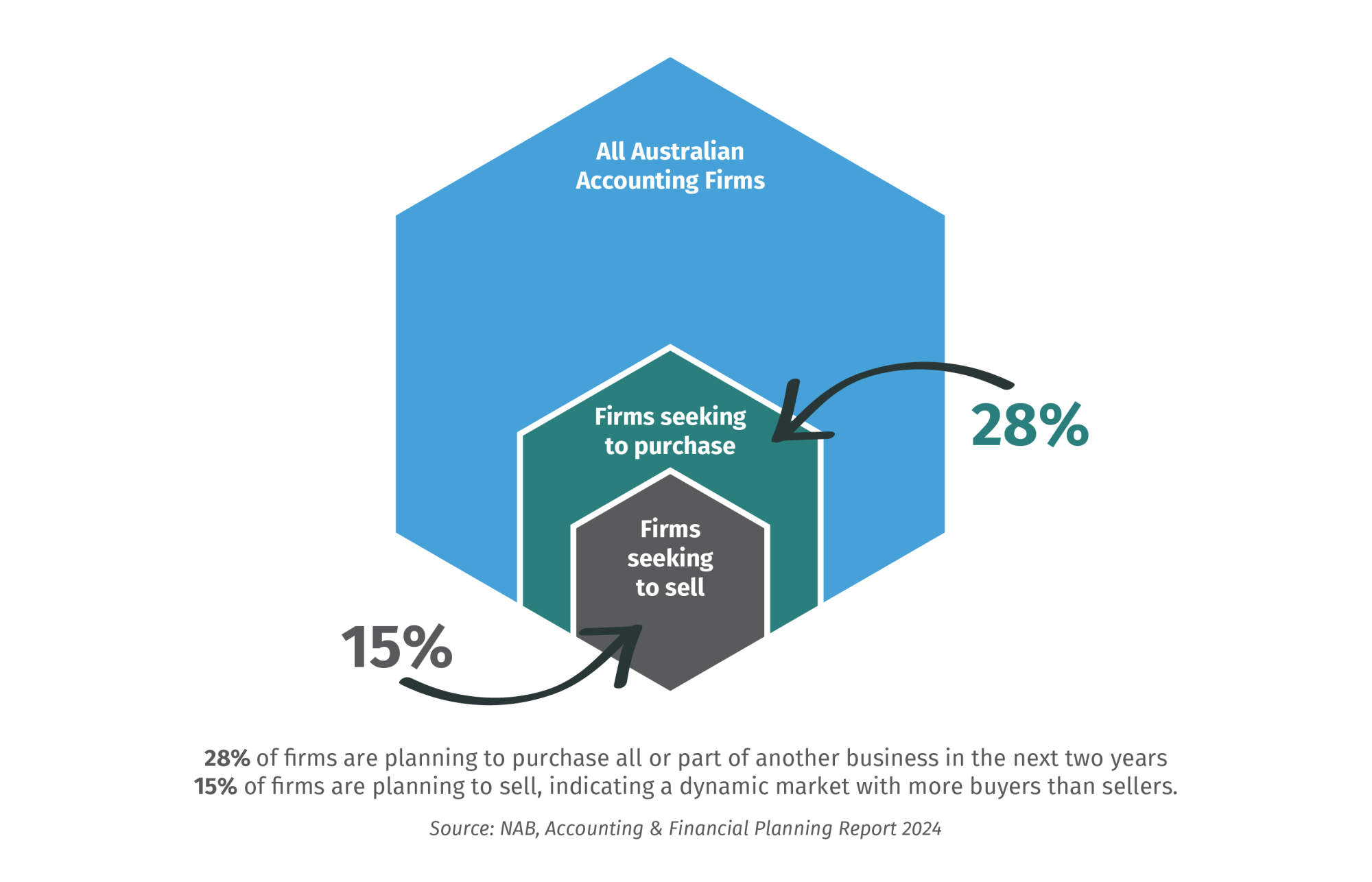

Mergers and acquisitions are gaining momentum as a strategic growth path, with 28 per cent of firms actively pursuing acquisition opportunities. We are already seeing this trend play out in the net movement of firms. While the number of accounting firms decreased by 0.5 per cent last year (172 entities), there was a 6.5 per cent increase in the number of firms employing 20-199 employees (31 entities). When reviewing the number of firms by employment size, we saw the largest decrease (at 6 per cent) occur in firms that had one to five employees according to the ABS.

This data suggests the decrease in total firms is a result of mergers and acquisitions rather than hard closures.

Research shows that only 15 per cent of firms are looking to sell, but more than a quarter of firms are considering purchasing as a growth option. For any firm considering selling, now is the time.

Cautious optimism

Traditionally, technology adoption in the accounting industry has moved at a cautious pace. This has been largely due to government and legal requirements that have burdened the industry with old-fashioned methods.

However, this might be the year that change picks up pace.

The combination of AI advancements, customer demand, skill shortages and a need to make accounting more engaging to workers may see more firms look strategically at their service offerings.

On the other side, we may also see the rise of the mid-tier firm (20-199 employees) with a focus on core services.

Either way, 77 per cent of firms expect a good or very good year of growth and this will be another busy, yet prosperous, year for the accounting industry.

Julia Thomson is head of data analytics and content at the Benchmarking Group.

Login

Login